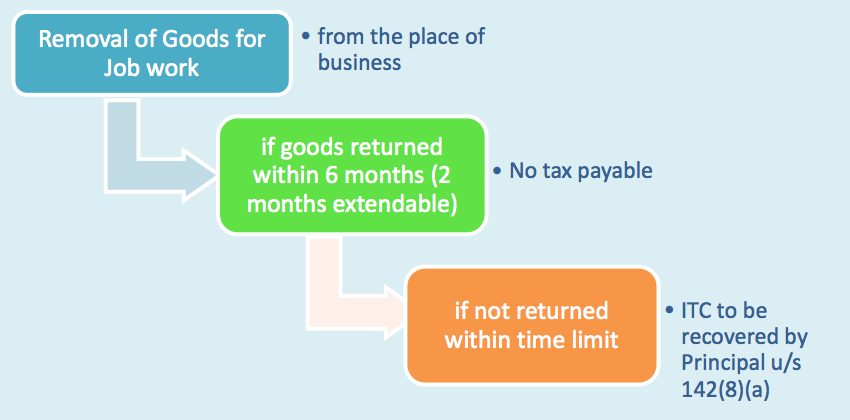

If above conditions are not fulfilled input tax credit claimed by the principal shall be liable to be recovered under section 142(8)(a) of the CGST Act, 2017. Proviso to section 141(2) & (3) provides that the manufacturer may, in accordance with the provisions of the existing law, transfer the said goods from the said other premises on payment of tax in India or without payment of tax for export Recommended Articles

Role of Company Secretary Role of CS in GST When will GST be applicable Filing of GST Returns Returns Under GST GST Registration GST Rates Role of CMAs in GST Role of Chartered Accountants HSN Code List GST Login GST Rules