As per the new system, the Way Bills will have to be generated and printed from the Directorate’s website www.wbcomtax.gov.in by the importing persons after furnishing the required particulars, which are described as under: –

WBGST E-Way Bill

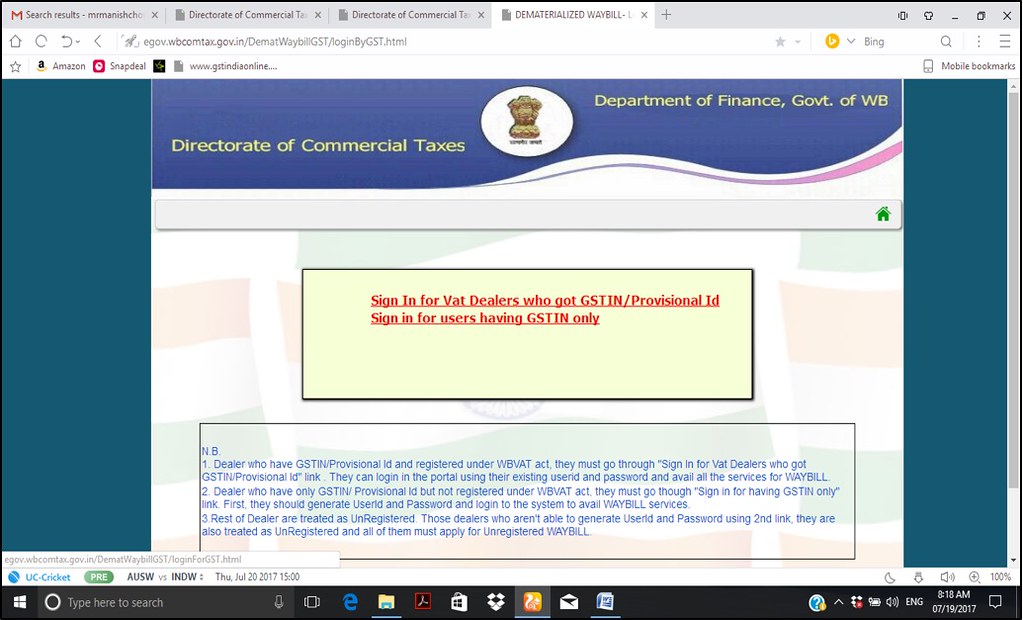

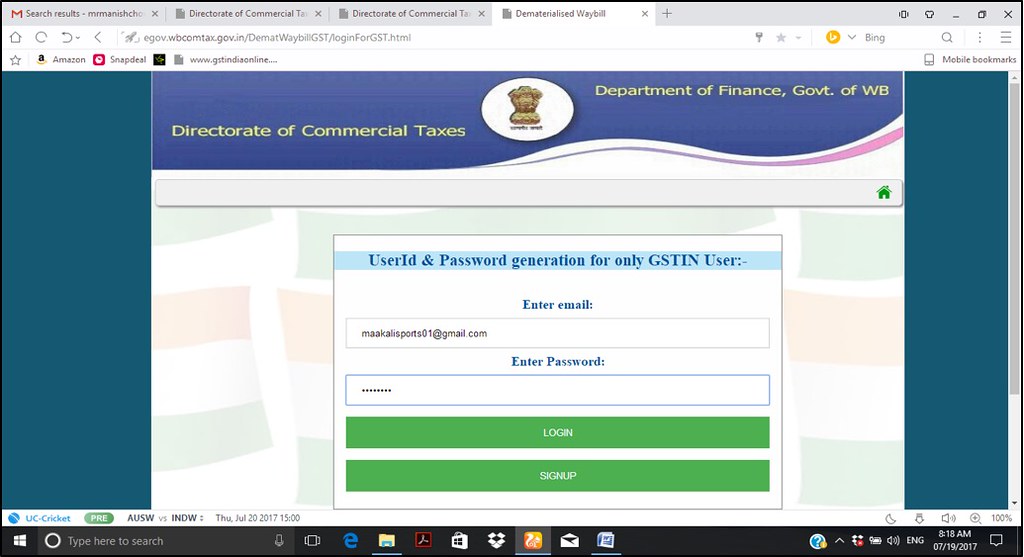

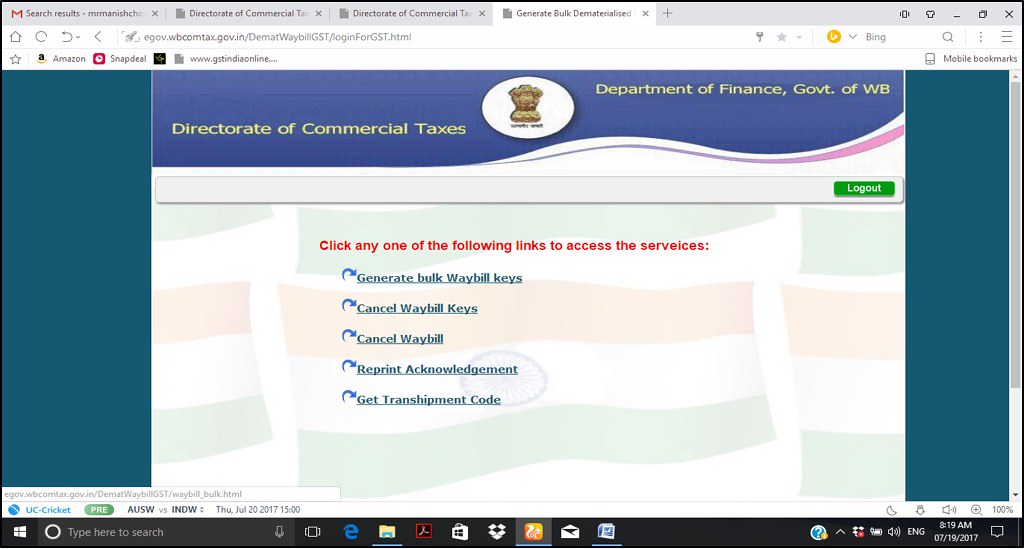

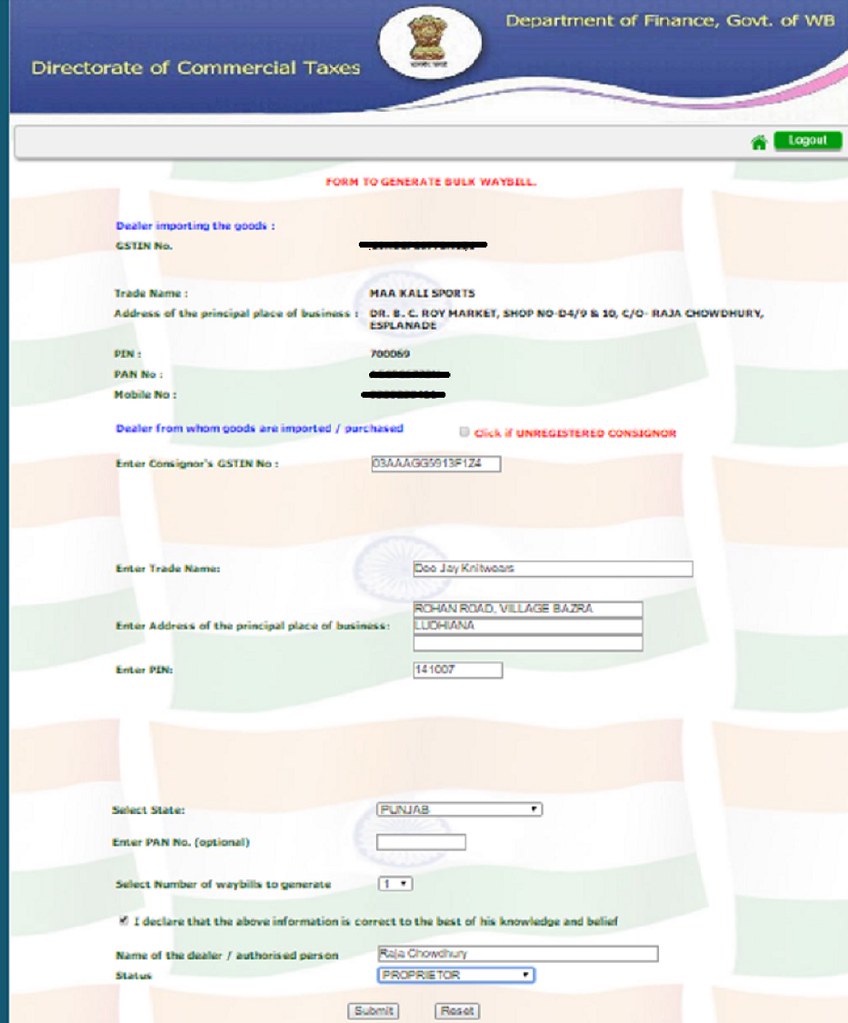

Who need to create key number?– Consignee is required to generate waybill key number and furnish the same to consignor or consignor’s agent. Using this key number, consignor or consignor’s agent will generate e-waybill. For generating waybill key number, only 2 steps need to be performed as mentioned below- Step 1: Login to West Bengal commercial tax website using login credentials or please click on Following link for direct visit on WBGST E-Way bill Generation page (Click Here) Following screen will appear, and then go to e-Services tab > Waybill > e-Waybill, as shown in the picture below with red arrow and red circle– Main Link: www.wbcomtax.gov.in->e-Services->waybill Then click on “Login for e-Waybill (Dematerialised Waybill for GST)” in the following screen as shown in the picture with red arrow– Then click on “Dematerialized Waybill- Consignee” in the following screen as shown in the picture with red arrow – Then click on “Sign In for users having GSTIN only” in the following screen as shown in the picture with red arrow – Then login page will come. Login with your login credentials as shown in the picture with red arrow – Please note: If you are first time user, then please click on sign up button (indicated with black arrow) ,and sign up with mail id and mobile number, and set your password. Then go for login with your login credentials. Step 2: After login, the next step is to generate the waybill key number. Once we login the following screen will come, then click on “Generate bulk Waybill Keys” as shown in picture with red arrow. Then the following screen will come. Fill the details as shown in the picture with red circle and click on “submit” button as shown with red arrow in picture- The moment we click on “submit” button, the “Acknowledgement Slip” screen will come as shown in below picture. Click on “print” and save it in your device, and send to consignor through mail or whatsapp. The consignor or his agent will generate Waybill using the key number generated by you.

WBGST Official E-Way Generation Facility

A. For Dealers/Taxable Persons having a valid GST Provisional ID/GSTIN Login Process: –

(a) VAT dealers can login with their existing VAT User ID and Password(b) Newly Registered GST dealers/persons shall have to create User ID and Password for first time login. After submitting GSTIN/Provisional ID, valid mobile No., valid e-mail ID, address, two separate OTPs will be sent to their respective mobile No. and mail ID. After successful submission of the two OTPs, the e-mail ID will be set as the User ID and he will be asked to set own password for login. No further creation of User ID is required for further login.

Waybill Generation:- 2-step process Step-1: Generation of bulk waybill keys for generation of Waybill Key Numbers required for generation of waybill in future

The topmost part of the form will be auto-populated with consignee data like Trade Name, PAN, Mobile No., etc.He shall have to enter details of Consignor like Trade name, GSTIN, address, State and also the number of keys required for the particular consignor, depending on the number of consignments.An acknowledgement with the requisite Waybill Key Numbers will be generated.Such keys may be used one at a time for generation of waybill.

Step-2: Generation of waybill using waybill key number

Login to the link Demat waybill consignor / consignee agentEnter GSTIN/Provisional ID, Waybill Key No. and captcha code and submitFill up details of invoices in downloadable blank annexure, save as xml file and uploadIn the opened form, enter Mode of Transport, Vehicle No. (if mode of transport is Road), Name/ Address/ Enrolment No. of the transporter/ owner of the vehicle, Details of Consignment Note / Railway receipt / Airway Bill / Bill of lading with date, Total no. of invoice/ Tax invoice/cash memo/ bills/challan/ forwarding note etc. (as per annexure),value of goods (as per annexure), Possible entry location, name of authorised person with status and after entering captcha code and clicking declaration, submit the details.Waybill will be generated with a preview.Take a printout.Reprint can also be taken in future.Other processes like cancellation of waybill keys/ waybills, transhipment shall be made following the same procedure as was existing under the WBVAT Act, 2003. Necessary user manual can be accessed under the link e-services->waybill->ewaybill link.

B. For Dealers/Taxable Persons/ Unregistered Persons not having any valid GST Provisional ID

Login: After going to the link Waybill application Waybill Generation: – The provisions shall be effective from 1st July, 2017 Recommended Articles

GST LoginHSN CodeGST RegistrationGST FormsGST Invoice FormatReturns Under GSTGST Anti profiteering RulesLegal Provisions for Anti ProfiteeringReverse Charge under GSTGST Reverse Charge