Looking to the concern of the exporters especially of services, the GST provisions for refund are simpler and have built in time limit on 90% for export/ SEZ refund claim. * 1

- 1 Chapter XI (Section 54 to 58) of the CGST Act, 2017 deals with the provisions of refunds under the GST regime. Similar provisions are applicable for UTGST

Refund under GST

II. Types of refund

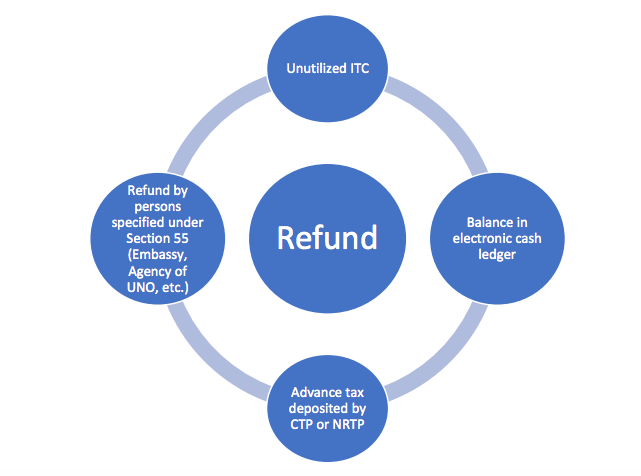

There are 4 types of refunds available in GST:- Details of forms required and time limit for claiming these refunds are hereunder:- Taxes claimed as refund = GST (CGST, IGST, SGST, UTGST), interest paid and any other amount (say, penalty, fees)

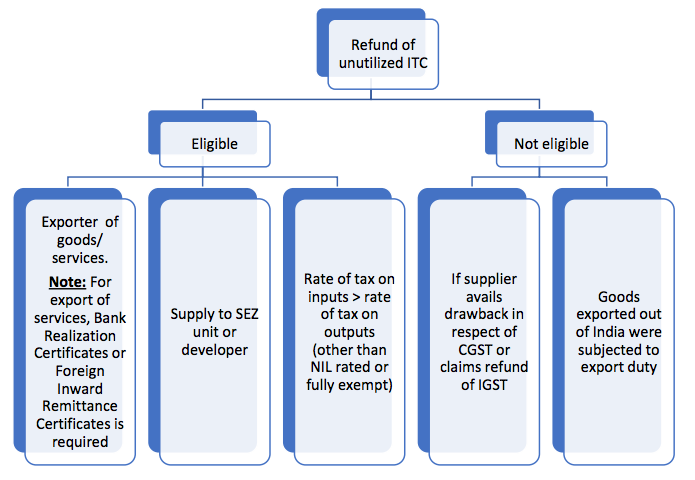

III. Eligibility & requirement for refund of unutilized ITC

Section 54(3) of CGST Act, 2017 and Rule 1 of Refund Rules provide for refund. Or As may be applicable, Or In the last return

Refund of tax on inward supply

Note 1: “refund” includes refund of tax paid on zero-rated supplies of goods or services or both or on inputs or input services used in making such zerorated supplies, or refund of tax on the supply of goods regarded as deemed exports, or refund of unutilised input tax credit as provided under sub-section (3) Note 2: If the person has defaulted in furnishing return or if the person is required to pay any taxes, then proper officer may withhold the refund or may deduct tax payable from the refund amount Note 3: If refund is on account of export or supply to SEZ, then 90% amount shall be refunded on provisional basis

IV. Meaning of relevant date:-

While claiming refund in above 4 situations, “relevant date” is crucial in different situations. Meaning of relevant date is as under:-

V. Documents required for filing refund of unutilized ITC

Documents to be enclosed for claiming refund by the exporter/Person supplying to SEZ/Person whose refund does not exceeds Rs. 2 Lacs, are:-

i. Export of goods – Statement containing details of bills of export, export invoices, etc.ii. Export of services – Statement containing details of invoices, BRC or FIRC.iii. Supply of goods/services to SEZ – Statement containing details of invoices, evidence regarding endorsement by specified officer regarding receipt of goods/services for authorized operations.iv. If refund claim < Rs. 2 Lakh – No documentary evidence – Only declaration that tax incidence is not passed on.

VI. Transfer to Consumer Welfare Fund

If the applicant is not able to follow the prescribed procedure as per rules, then in such cases the amount of refund claimed will be transferred to Consumer Welfare Fund. Cases where the same is not applicable are, i.e. refund is not to be transferred to consumer welfare fund in the following cases:-

i. It’s a case of tax paid on Export/sale to SEZ or inputs/input services used.ii. Refund of unutilized ITCiii. Refund of tax on supply which is not provided and (invoice not been issued/refund voucher issued)iv. Refund of tax wrongfully collected and paid.v. Tax incidence not passed on.

VII. Section 56 of CGST Act – Interest on delayed refunds

As per the current provisions of Service Tax and Excise, if refund is not granted within 3 months, interest is payable @6% p.a. from the date of receipt of application by the Department. In GST, the provisions are as under:-

VIII. Types of Forms relating to refund

The industry is eagerly waiting for the GST to be implemented and the exporters are looking forward to be much more globally competitive with icing on the cake of refunds with minimum costs in a time bound manner. Interest up to 9% – If not refunded within 60 days of application filed after the favourable order by adjudicating or appellate authority or court.

GST ScopeGST ReturnGST FormsGST RateGST RegistrationWhat is GST?GST Invoice FormatGST Composition SchemeHSN CodeGST LoginGST RulesGST StatusTrack GST ARNTime of Supply