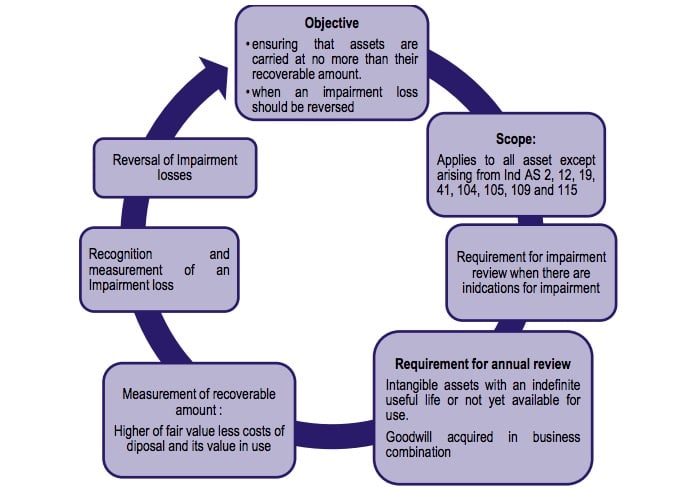

An entity shall assess at the end of each reporting period whether there is any indication that an asset may be impaired. If any such in dication exists, the entity shall estimate the recoverable amount of the asset. However, irrespective of whether there is any indication of impairment, an entity shall also:

test an intangible asset with an indefinite useful life or an intangible asset not yet available for use for impairment annually by comparing its carrying amount with its recoverable This impairment test may be performed at any time during an annual period, provided it is performed at the same time every year. Different intangible assets may be tested for impairment at different times. However, if such an intangible asset was initially recognised during the current annual period, that intangible asset shall be tested for impairment before the end of the current annual period.test goodwill acquired in a business combination for impairment annually in accordance with paragraphs 80–99 of the

If there is an indication that an asset may be impaired, the recoverable amount shall be estimated for the individual assets. If it is not possible to estimate the recoverable amount of the individual asset, the entity shall determine the recoverable amount of the cash-generating unit to which the asset belongs (the asset’s cash-generating unit). A cash-generating unit is the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets.

Measuring cash generating unit

The recoverable amount of an asset or a cash-generating unit is the higher of its fair value less costs of disposal and its value in use. It is not always necessary to determine both an asset’s fair value less costs of disposal and its value in use. If either of these amounts exceeds the asset’s carrying amount, the asset is not impaired and it is not necessary to estimate the other amount. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Costs of disposal are incremental costs directly attributable to the disposal of an asset or cash-generating unit, excluding finance costs and income tax expense. Value in use is the present value of the future cash flows expected to be derived from an asset or cash-generating unit. The following elements shall be reflected in the calculation of an asset’s value in use:

an estimate of the future cash flows the entity expects to derive from the asset;expectations about possible variations in the amount or timing of those future cash flows;the time value of money, represented by the current market risk-free rate of interest;the price for bearing the uncertainty inherent in the asset; andother factors, such as illiquidity, that market participants would reflect in pricing the future cash flows the entity expects to derive from the asset.

Estimates of future cash flows shall include:

projections of cash inflows from the continuing use of the asset;projections of cash outflows that are necessarily incurred to generate the cash inflows from continuing use of the asset (including cash outflows to prepare the asset for use) and can be directly attributed, or allocated on a reasonable and consistent basis, to the asset; andnet cash flows, if any, to be received (or paid) for the dis posal of the asset at the end of its useful

Future cash flows shall be estimated for the asset in its current condition. Estimates of future cash flows shall not include estimated future cash inflows or outflows that are expected to arise from:

a future restructuring to which an entity is not yet committed; orimproving or enhancing the asset’s Estimates of future cash flows shall not include:cash inflows or outflows from financing activities; orincome tax receipts or

Recognising and measuring an impairment loss

If, and only if, the recoverable amount of an asset is less than its carrying amount, the carrying amount of the asset shall be reduced to its recoverable amount. That reduction is an impairment loss. An impairment loss shall be recognised immediately in profit or loss unless the asset is carried at the revalued amount in accordance with another Standard (for example, in accordance with the revaluation model in Ind AS 16). Any impairment loss of a revalued asset shall be treated as a revaluation decrease in accordance with that other Standard. An impairment loss shall be recognised for a cash-generating unit (the smallest group of cash-generating units to which goodwill or a corporate asset has been allocated) if, and only if, the recoverable amount of the unit (group of units) is less than the carrying amount of the unit (group of units). The impairment loss shall be allocated to reduce the carrying amount of the assets of the unit (group of units) in the following order:

first, to reduce the carrying amount of any goodwill allocated to the cash-generating unit (group of units); andthen, to the other assets of the unit (group of units) pro rata on the basis of the carrying amount of each asset in the unit (group of units).

However, an entity shall not reduce the carrying amount of an asset below the highest of:

its fair value less costs of disposal (if measurable);its value in use (if determinable); andZero

The amount of the impairment loss that would otherwise have been allocated to the asset shall be allocated pro rata to the other assets of the unit (group of units).

Goodwill

For the purpose of impairment testing, goodwill acquired in a business combination shall, from the acquisition date, be allocated to each of the acquirer’s cash-generating units, or groups of cash-generating units, that is expected to benefit from the synergies of the combination, irrespective of whether other assets or liabilities of the acquiree are assigned to those units or groups of units. The annual impairment test for a cash-generating unit to which goodwill has been allocated may be performed at any time during an annual period, provided the test is performed at the same time every year. Different cash-generating units may be tested for impairment at different times. However, if some or all of the goodwill allocated to a cash-generating unit was acquired in a business combination during the current annual period, that unit shall be tested for impairment before the end of the current annual period. The Standard permits the most recent detailed calculation made in a preceding period of the recoverable amount of a cash-generating unit to which goodwill has been allocated to be used in the impairment test of that unit in the current period provided specified criteria are met

Reversing an impairment loss

An entity shall assess at the end of each reporting period whether there is any indication that an impairment loss recognised in prior periods for an asset other than goodwill may no longer exist or may have decreased. If any such indication exists, the entity shall estimate the recoverable amount of that asset. An impairment loss recognised in prior periods for an asset other than goodwill shall be reversed if, and only if, there has been a change in the estimates used to determine the asset’s recoverable amount since the last impairment loss was recognised. A reversal of an impairment loss for a cash-generating unit shall be allocated to the assets of the unit, except for goodwill, pro rata with the carrying amounts of those assets. A reversal of an impairment loss for an asset other than goodwill shall be recognised immediately in profit or loss unless the asset is carried at the revalued amount in accordance with another Indian Accounting Standard (for example, the revaluation model in IndAS 16). Any reversal of an impairment loss of a revalued asset shall be treated as a revaluation increase in accordance with that other Indian Accounting Standard. An impairment loss recognised for goodwill shall not be reversed in a subsequent period.

Difference Between AS 28 and Ind AS 36

Recommended Articles

Types of VouchersTypes of LeaseScope of AccountingBasic Principles of AccountingCA Final Admit CardCA Final RTPPan Card StatusCA IPCC RTPCA Final Question PapersIncome Tax Slab RatesSub Fields of Accounting