Step by Step Guide for Reset Income tax India Efiling Password. Incometax E-Filing Return Forget Password Procedure for AY 2017-18 and FY 2016-17. Here we are providing complete procedure for How to Reset Incometaxindiaefiling Login Password, E-filing How to Reset Income Tax Login Password. Recently we provide complete details for How to E-File Income Tax Return Online 2017-18. Now you can scroll down below and check complete details for “Incometaxindiaefiling – How to Reset Login Password”

Incometaxindiaefiling – How to Reset Login Password

Reset Password Options

Registered user can reset the password using one of the following options:

Answer Secret Question.Upload Digital Signature CertificateUsing OTP (PINs)Using Aadhaar OTP

Reset password by Answer Secret Question

To Reset Password using the „Answer Secret Question‟ option, the steps are as below:

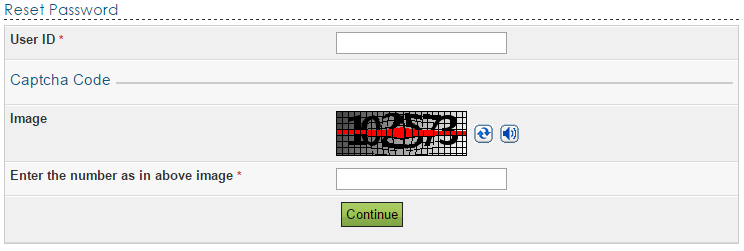

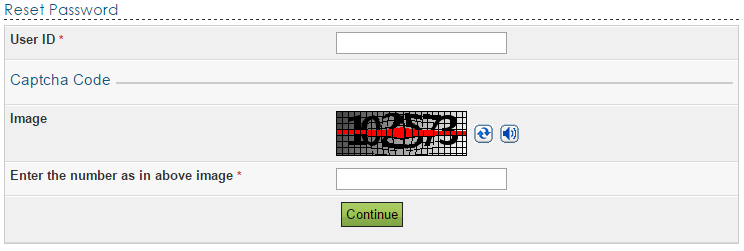

Step 1: In Homepage, Click on “LOGIN HERE”Step 2: Click on “FORGOT PASSWORD” linkStep 3: User must provide User ID, CAPTCHA and click on CONTINUE button.Step 4: Select “Answer Secret Question” from the drop down options available.Step 5: Enter the Date of Birth/Incorporation from the Calendar provided (Mandatory)Step 6: Select the Secret Question from the drop down options available (Mandatory)Step 7: Enter the “Secret Answer” and Click on “VALIDATE”.Step 8: On success, the user must enter the New Password and confirm the password.Step 9: Click on “SUBMIT”

Once the password has been changed a success message will be displayed. User can login with new password.

Reset password by Upload Digital Signature Certificate

To Reset Password using the „Upload Digital Signature Certificate‟ option, the steps are as follows:

Step 1: In Homepage, Click on “LOGIN HERE”Step 2: Click on “FORGOT PASSWORD” link.Step 3: User must provide User ID, CAPTCHA and click on CONTINUE button.Step 4: Select “Upload Digital Signature Certificate” from the drop down availableStep 5: User can select any one of the two options provided: i. New DSC ii. Registered DSC Step 6: User must Upload DSC and click on the “VALIDATE” button. The DSC is validated.Step 7: On success, the user must enter the New Password and confirm the password.Step 8: Click on “SUBMIT” Once the password has been changed a success message will be displayed. User can login with new password.

Once the password has been changed a success message will be displayed. User can login with new password.

Reset password by Using OTP (PINs)

To Reset Password using the “Using OTP (PINs)” option, the steps are as follows:

Step 1: In Homepage, Click on “LOGIN HERE”Step 2: Click on “FORGOT PASSWORD” link.Step 3: User must provide User ID, CAPTCHA and click on CONTINUE button.Step 4: Select “One Time Password” from the drop down options available.Step 5: The user must select one of the options mentioned below Registered Email ID and Mobile Number New Email ID and Mobile Number

Note: Step 2: Click on “CONTINUE”. PINs would be sent to registered Email ID and Mobile Number. Step 3: The user must enter the PINs received to the registered Email ID and Mobile Number and Click on “VALIDATE. Step 4: On success, the user must enter the New Password and confirm the password. Step 5: Click on “SUBMIT” Step 6: Once the reset password request has been submitted, a success message will be displayed. User can login with new password after the time specified in communication. a. 26AS TAN – The user must TAN of Deductor, as available in 26AS. b. OLTAS CIN – The user must enter the BSR Code, Challan Date and Challan Identification Number (CIN) as available in 26AS. c. Bank Account Number – The user must enter the Bank Account number as mentioned in Income Tax Return. Note: Please enter the details as per any of the e-Filed returns from AY 2012-13 onwards Step 2: Click on “CONTINUE”. PINs would be sent to registered Email ID and Mobile Number Step 3: The user must enter the PINs received to the provided Email ID and Mobile Number and Click on “VALIDATE” Step 4: On success, the user must enter the New Password and confirm the password. Step 5: Click on “SUBMIT” Step 6: Once the reset password request has been submitted, a success message will be displayed. User can login with new password after the time specified in communication.

In case, the user has not received the PINs in a reasonable time, user can opt for Resend PINsAn email along with a link for “Cancellation for the password reset request” will be shared to the registered Email ID and new Email ID. In case the user identifies the request for password reset is un-authorized, then user can click on the Cancellation link provided within 12hours. PAN and DOB validation will be done before aborting the password reset request.

Reset password by Using Aadhaar OTP

Pre-requisite: To generate Aadhaar OTP, Taxpayer’s PAN and Aadhaar must be linked. To Reset Password using the ‘Using Aadhaar OTP’ option, the steps are as follows:

Step 1: In Homepage, Click on “LOGIN HERE”Step 2: Click on “FORGOT PASSWORD” link.Step 3: User must provide User ID, CAPTCHA and click on CONTINUE button.Step 4: Select ‘Using Aadhaar OTP’ from the drop down available and click on CONTINUE button.Step 5: User will be redirected to a page where he can confirm his Aadhaar Number. Click “Generate Aadhaar OTP”.Step 6: Aadhaar OTP will be generated and sent to the Mobile Number registered with Aadhaar. User must enter the Aadhaar OTP received and click on the “VALIDATE” button. The Aadhaar OTP is validated.Step 7: On success, the user must enter the New Password and confirm the password.Step 8: Click on “SUBMIT” Once the password has been changed a success message will be displayed. User can login with new password.

e-Filing Login Through NetBanking

Registered Taxpayer can login through NetBanking and reset the password. NetBanking Login: To Reset Password using the „NetBanking Login‟, the steps are as follows:

Step 1: In Homepage, Click on “Login Here”Step 2: Click on “Forgot Password” link.Step 3: Enter User ID (PAN), Captcha and Click on Continue button.Step 4: Click on “e-Filing Login Through NetBanking” link.Step 5: Select the Bank from the list of Banks providing the e-Filing login facilityStep 6: After login to NetBanking account, click on the link “Login to the IT e-Filing account” e-Filing user Dashboard screen shall be displayed.Step 7: Taxpayer can change the password under Profile settings.

List of Banks providing the e-Filing login facility

- Allahabad Bank 2. Andhra Bank 3. Axis Bank Ltd 4. Bank of Baroda 5. Bank of India 6. Bank of Maharastra 7. Canara Bank 8. Central Bank of India 9. City Union Bank Ltd 10. Corporation Bank-Corporate Banking 11. Corporation Bank-Retail Banking 12. DENA BANK 13. HDFC Bank 14. ICICI Bank 15. IDBI Bank 16. Indian Bank 17. Indian Overseas Bank 18. Kotak Mahindra Bank 19. Oriental Bank of Commerce 20. Punjab National Bank 21. State Bank of Bikaner and Jaipur 22. State Bank of Hyderabad 23. State Bank of India 24. State Bank of Mysore 25. State Bank of Patiala 26. State Bank of Travancore 27. Syndicate Bank 28. UCO Bank 29. Union Bank of India 30. United Bank of India 31. Vijaya Bank Recommended Articles

Calculation and Taxability of House Rent Allowance (HRA) Revised Fee for Delayed Filing of Income Tax Return List of Taxes which Common Man pay in IndiaDownload Form 3CA 3CB 3CD In Word Excel & Java FormatDeduction For Medical Insurance Premium U/Sec 80dIncome Tax Return FormsProcedure For E-Filling of Tax Audit ReportIncome Tax Due DatesDownload Latest Income Tax Challans

If you have any query or suggestion regarding “Incometaxindiaefiling – How to Reset Login Password” then please tell us via below comment box….

title: “Incometaxindiaefiling How To Reset Login Password For E Filing” ShowToc: true date: “2023-01-07” author: “Wallace Kendrick”

Step by Step Guide for Reset Income tax India Efiling Password. Incometax E-Filing Return Forget Password Procedure for AY 2017-18 and FY 2016-17. Here we are providing complete procedure for How to Reset Incometaxindiaefiling Login Password, E-filing How to Reset Income Tax Login Password. Recently we provide complete details for How to E-File Income Tax Return Online 2017-18. Now you can scroll down below and check complete details for “Incometaxindiaefiling – How to Reset Login Password”

Incometaxindiaefiling – How to Reset Login Password

Reset Password Options

Registered user can reset the password using one of the following options:

Answer Secret Question.Upload Digital Signature CertificateUsing OTP (PINs)Using Aadhaar OTP

Reset password by Answer Secret Question

To Reset Password using the „Answer Secret Question‟ option, the steps are as below:

Step 1: In Homepage, Click on “LOGIN HERE”Step 2: Click on “FORGOT PASSWORD” linkStep 3: User must provide User ID, CAPTCHA and click on CONTINUE button.Step 4: Select “Answer Secret Question” from the drop down options available.Step 5: Enter the Date of Birth/Incorporation from the Calendar provided (Mandatory)Step 6: Select the Secret Question from the drop down options available (Mandatory)Step 7: Enter the “Secret Answer” and Click on “VALIDATE”.Step 8: On success, the user must enter the New Password and confirm the password.Step 9: Click on “SUBMIT”

Once the password has been changed a success message will be displayed. User can login with new password.

Reset password by Upload Digital Signature Certificate

To Reset Password using the „Upload Digital Signature Certificate‟ option, the steps are as follows:

Step 1: In Homepage, Click on “LOGIN HERE”Step 2: Click on “FORGOT PASSWORD” link.Step 3: User must provide User ID, CAPTCHA and click on CONTINUE button.Step 4: Select “Upload Digital Signature Certificate” from the drop down availableStep 5: User can select any one of the two options provided: i. New DSC ii. Registered DSC Step 6: User must Upload DSC and click on the “VALIDATE” button. The DSC is validated.Step 7: On success, the user must enter the New Password and confirm the password.Step 8: Click on “SUBMIT” Once the password has been changed a success message will be displayed. User can login with new password.

Once the password has been changed a success message will be displayed. User can login with new password.

Reset password by Using OTP (PINs)

To Reset Password using the “Using OTP (PINs)” option, the steps are as follows:

Step 1: In Homepage, Click on “LOGIN HERE”Step 2: Click on “FORGOT PASSWORD” link.Step 3: User must provide User ID, CAPTCHA and click on CONTINUE button.Step 4: Select “One Time Password” from the drop down options available.Step 5: The user must select one of the options mentioned below Registered Email ID and Mobile Number New Email ID and Mobile Number

Note: Step 2: Click on “CONTINUE”. PINs would be sent to registered Email ID and Mobile Number. Step 3: The user must enter the PINs received to the registered Email ID and Mobile Number and Click on “VALIDATE. Step 4: On success, the user must enter the New Password and confirm the password. Step 5: Click on “SUBMIT” Step 6: Once the reset password request has been submitted, a success message will be displayed. User can login with new password after the time specified in communication. a. 26AS TAN – The user must TAN of Deductor, as available in 26AS. b. OLTAS CIN – The user must enter the BSR Code, Challan Date and Challan Identification Number (CIN) as available in 26AS. c. Bank Account Number – The user must enter the Bank Account number as mentioned in Income Tax Return. Note: Please enter the details as per any of the e-Filed returns from AY 2012-13 onwards Step 2: Click on “CONTINUE”. PINs would be sent to registered Email ID and Mobile Number Step 3: The user must enter the PINs received to the provided Email ID and Mobile Number and Click on “VALIDATE” Step 4: On success, the user must enter the New Password and confirm the password. Step 5: Click on “SUBMIT” Step 6: Once the reset password request has been submitted, a success message will be displayed. User can login with new password after the time specified in communication.

In case, the user has not received the PINs in a reasonable time, user can opt for Resend PINsAn email along with a link for “Cancellation for the password reset request” will be shared to the registered Email ID and new Email ID. In case the user identifies the request for password reset is un-authorized, then user can click on the Cancellation link provided within 12hours. PAN and DOB validation will be done before aborting the password reset request.

Reset password by Using Aadhaar OTP

Pre-requisite: To generate Aadhaar OTP, Taxpayer’s PAN and Aadhaar must be linked. To Reset Password using the ‘Using Aadhaar OTP’ option, the steps are as follows:

Step 1: In Homepage, Click on “LOGIN HERE”Step 2: Click on “FORGOT PASSWORD” link.Step 3: User must provide User ID, CAPTCHA and click on CONTINUE button.Step 4: Select ‘Using Aadhaar OTP’ from the drop down available and click on CONTINUE button.Step 5: User will be redirected to a page where he can confirm his Aadhaar Number. Click “Generate Aadhaar OTP”.Step 6: Aadhaar OTP will be generated and sent to the Mobile Number registered with Aadhaar. User must enter the Aadhaar OTP received and click on the “VALIDATE” button. The Aadhaar OTP is validated.Step 7: On success, the user must enter the New Password and confirm the password.Step 8: Click on “SUBMIT” Once the password has been changed a success message will be displayed. User can login with new password.

e-Filing Login Through NetBanking

Registered Taxpayer can login through NetBanking and reset the password. NetBanking Login: To Reset Password using the „NetBanking Login‟, the steps are as follows:

Step 1: In Homepage, Click on “Login Here”Step 2: Click on “Forgot Password” link.Step 3: Enter User ID (PAN), Captcha and Click on Continue button.Step 4: Click on “e-Filing Login Through NetBanking” link.Step 5: Select the Bank from the list of Banks providing the e-Filing login facilityStep 6: After login to NetBanking account, click on the link “Login to the IT e-Filing account” e-Filing user Dashboard screen shall be displayed.Step 7: Taxpayer can change the password under Profile settings.

List of Banks providing the e-Filing login facility

- Allahabad Bank 2. Andhra Bank 3. Axis Bank Ltd 4. Bank of Baroda 5. Bank of India 6. Bank of Maharastra 7. Canara Bank 8. Central Bank of India 9. City Union Bank Ltd 10. Corporation Bank-Corporate Banking 11. Corporation Bank-Retail Banking 12. DENA BANK 13. HDFC Bank 14. ICICI Bank 15. IDBI Bank 16. Indian Bank 17. Indian Overseas Bank 18. Kotak Mahindra Bank 19. Oriental Bank of Commerce 20. Punjab National Bank 21. State Bank of Bikaner and Jaipur 22. State Bank of Hyderabad 23. State Bank of India 24. State Bank of Mysore 25. State Bank of Patiala 26. State Bank of Travancore 27. Syndicate Bank 28. UCO Bank 29. Union Bank of India 30. United Bank of India 31. Vijaya Bank Recommended Articles

Calculation and Taxability of House Rent Allowance (HRA) Revised Fee for Delayed Filing of Income Tax Return List of Taxes which Common Man pay in IndiaDownload Form 3CA 3CB 3CD In Word Excel & Java FormatDeduction For Medical Insurance Premium U/Sec 80dIncome Tax Return FormsProcedure For E-Filling of Tax Audit ReportIncome Tax Due DatesDownload Latest Income Tax Challans

If you have any query or suggestion regarding “Incometaxindiaefiling – How to Reset Login Password” then please tell us via below comment box….