By using this page you may check GST Registration Status, GST Refund Status, Track GST Status, Know your GSTIN, Check GST Number Status, GST ARN Status etc.. please follow below procedure to know details for above tasks….

GST Registration Status, Track GST Registration Status

I am an existing taxpayer. How can I track status of my application for enrolment with GST that I have submitted?

GST Registration window will be re-opened so here you may check GST ARN Status from the below link. As an existing taxpayer, you can enroll with GST at the GST Common Portal. On submission of the Enrolment Application, you will be given an Application Reference Number (ARN). You can track the status of your application by tracking this ARN.

How to Track GST Status

What all Statuses are possible for the Registration and what these Statuses indicates?

Following Statuses are possible: Click Here to Check GST Provisional ID Status Click Here to Check GST Provisional ID Status Search Tax Payer by GSTIN Number, UIN Number or GST Number a) Provisional: It indicates that Provisional ID is issued but Application for Enrolment of Existing Taxpayer is yet to be filed after attaching digital signatures. b) Pending for Verification: It indicates that application submitted is successfully, however validation by the system with external agencies is under processing. The status will get updated once verification is completed. c) Validation against Error: The PAN details entered does not match with CBDT database. Kindly fill the details as per PAN details and resubmit the form. d) Migrated: The application has been successfully migrated under GST. No changes can be done to the Application now. Provisional Registration certificate shall be made available at the portal after appointed date i.e. the date on which GST Act will come into force. e) Cancelled: Existing Registration is cancelled, therefore, Provisional ID stands cancelled.

Track GST Application Status > Pre Login

I am a taxpayer. How can I track status of my registration application that I have submitted without logging to the GST Portal? On submission of the registration application, you will be given an Application Reference Number (ARN). You can track status of your application by tracking this ARN. To view status of your ARN without logging to the GST Portal, perform the following steps:

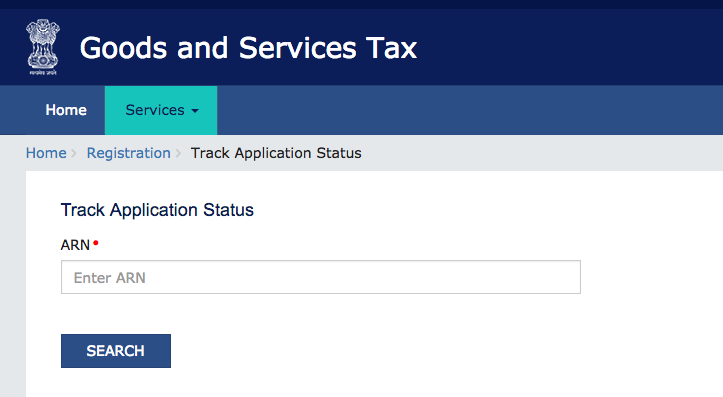

- Access the https://www.gst.gov.in/ URL. The GST Home page is displayed.

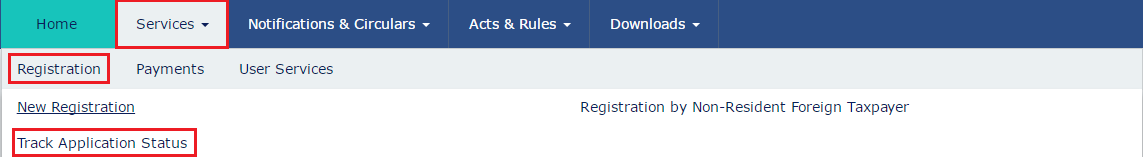

- Click the Services > Registration > Track Application Status command.

- In the ARN field, enter the ARN received on your e-mail address when you submitted the registration application.

- In the Type the characters you see in the image below field, enter the captcha text.

- Click the SEARCH button. The Application status is displayed. In this article you may find complete details for how a user can track his GST Registration status via online…There are many queries related to GST Status like – I am an existing taxpayer, How can I track status of my application for enrolment with GST that I have submitted?. I had saved my enrolment application but not completed it. How can I access my saved application?, Enrolment Activities Post Appointed Date etc….Now check more details form below…

What all Statuses are possible for the Registration and what these Statuses indicates?

How to Download GST Registration Certificate

How can I view or download the Registration Certificate?

To view or download the Registration Certificate, perform the following steps:

- Login to the GST Portal with the valid credentials.2. Click the Services > User Services > View or Download Certificates command.3. The View / Download Certificates page is displayed. Click the Download button to download the certificate.

Open the downloaded certificate to view the Registration Certificate.

Enrolment Activities Post Appointed Date

- Can the Enrolment Application of a taxpayer get rejected? Yes, the Enrolment Application for enrolment under GST can be rejected in case incorrect details have been furnished or uploaded fake or incorrect documents have been attached with the Enrolment Application and the application is electronically signed. However, the applicant taxpayer will be provided reasonable opportunity of being heard where applicant taxpayer can present his or her viewpoints.

- Can amendments be made after the enrolment application is submitted? Yes, the Enrolment Application can be amended after the appointed date.

- Can the mobile number and e-mail address given at the time of enrolment be changed after enrolment? Yes, the mobile number and e-mail address can be changed after the appointed date on following the amendment process.

- When will Provisional Registration Certificate be issued? The Provisional Registration Certificate will be available for viewing and download at the Dashboard of the GST Common Portal on the appointed date. The certificate will be available only if the Registration Application was submitted successfully.

- When will Final Registration Certificate be issued? The final Registration Certificate will be issued within 6 months of verification of documents by authorized Center/ State officials of the concerned Jurisdiction (s) after the appointed date.