The tourism and Hospitality Industry have various segments like Accommodation and catering, Transportation, Attractions (Theme Park, Monuments, Nature, events) & travel agency/ tour operators. In this article we are covering GST for Travel Agents and Tour Operators. “tour operator” means any person engaged in the business of planning, scheduling, organizing, arranging tours (which may include arrangements for accommodation, sightseeing, or other similar services) by any mode of transport, and includes any person engaged in the business of operating tours;

Current Business Models –

Tour Package :- Here total booking is done by the tour operator and the total fees charged shall include his margin .So the Tour Operator become service provider and in turn he receives services from various other counterparts like Airline Companies, Hotel, Local Taxi Operators, Restaurants, Embassy issuing visas. Pure Agent Tour Operator :- The tour operator only facilitates the transaction and helps traveller to identify various suppliers as per their requirements and arrange for its booking. Payment flow goes straight away from actual traveller to end service provider and tour operator only charges for its service portion from traveller. As per rule 33 of CGST Rules 2017 – Value of supply of services in case travel agent acts as Pure agent is, the expenditure or costs incurred by a supplier as a pure agent of the recipient of supply shall be excluded from the value of supply, if all the following conditions are satisfied, namely,-

i) the supplier acts as a pure agent of the recipient of the supply, when he makes the payment to the third party on authorisation by such recipient;(ii) the payment made by the pure agent on behalf of the recipient of supply has been separately indicated in the invoice issued by the pure agent to the recipient of service; and(iii) the supplies procured by the pure agent from the third party as a pure agent of the recipient of supply are in addition to the services he supplies on his own account.

Explanation.- For the purposes of this rule, the expression “pure agent” means a person who-

(a) enters into a contractual agreement with the recipient of supply to act as his pure agent to incur expenditure or costs in the course of supply of goods or services or both;(b) neither intends to hold nor holds any title to the goods or services or both so procured or supplied as pure agent of the recipient of supply;(c) does not use for his own interest such goods or services so procured; and(d) receives only the actual amount incurred to procure such goods or services in addition to the amount received for supply he provides on his own account.

Hotel and Flight booking with Backend Commission- Here Tour operator does not charge any fees from the customer. He only facilitates the transaction and help traveller to identify various suppliers as per their requirements and arrange for its bookings. In turn the ultimate supplier pays commission for promotion and generating sales for them. It is mainly used in Hotel Booking & Flight Booking

Registration requirements

Every supplier who makes a taxable supply of goods/ services and his aggregate turnover in financial year exceeds Twenty Lakh Rupees shall be liable to be registered under GST. The Limit is Ten Lakh in case of special category of states. Further threshold limit of Rs. 20,00,000 is not applicable in following cases:

Person making any inter-sate taxable supply

Person who makes taxable supply of goods or service or both on behalf of other taxable person whether as an agent or otherwise, such as Air Travel Agent. Major sources of income of Tour Operators & Travel Agents:

Commission from Airline’s & Segment payout from CRS Companies.Sale Tour Packages, both inbound and outboundTravel Related Services like Visa, Passport etc.Hotel BookingsCAR Rental Services, Travel InsuranceRailway Reservations

SAC Codes for Travel Agents for Outward supply

Now we shall deal how GST is calculated on these items. An Air Travel Agent gets commission from the Airlines for booking of air tickets further he also gets income in the form of processing fees etc . from the client for whom he books the tickets. Since the income is generated from airlines as well as the client there are two parties involved and hence two separate invoices have to be issued. Accordingly GST has to be paid on commission / PLB / upload- incentive / any other form of service fees from Passenger. Option A GST @ 18% on Commission /PLA upload incentive / any other form of incentive on Issue of invoice on Airline/ Consolidator. Service Fees @ 18% on Issue invoice on Passenger . OR Option B Rule 32 of CGST Rules-The value of supply of services in relation to booking of tickets for travel by air provided by an air travel agent, shall be deemed to be an amount calculated at the rate of 5%. of the basic fare in the case of domestic bookings, and at the rate of 10% of the basic fare in the case of international bookings of passage for travel by air. Explanation – For the purposes of this sub-rule, the expression “basic fare” means that part of the air fare on which commission is normally paid to the air travel agent by the airline. Accordingly – GST on basic fare- For domestic booking 0.9% of Basis Fare and For International Booking 1.8% of basis fare. Now Air Travel agent can pay tax on any of the option given above . Which tax to be imposed -IGST OR CGST+SGST In terms of Sec. 12(2) of IGST Act, When an Air Travel Agent provides services to a person who is located in India and the person is registered under the GST law then the place of Supply shall be the location of service receiver. If the services are provided to a person located in India but not registered under the GST Law but his address is available on records then the place of Supply shall be the location of the service receiver. If the services are provided to a person located in India but not registered under the GST Law and his address is not available on records then the place of Supply shall be the location of the service provider.

In case the recipient is outside India

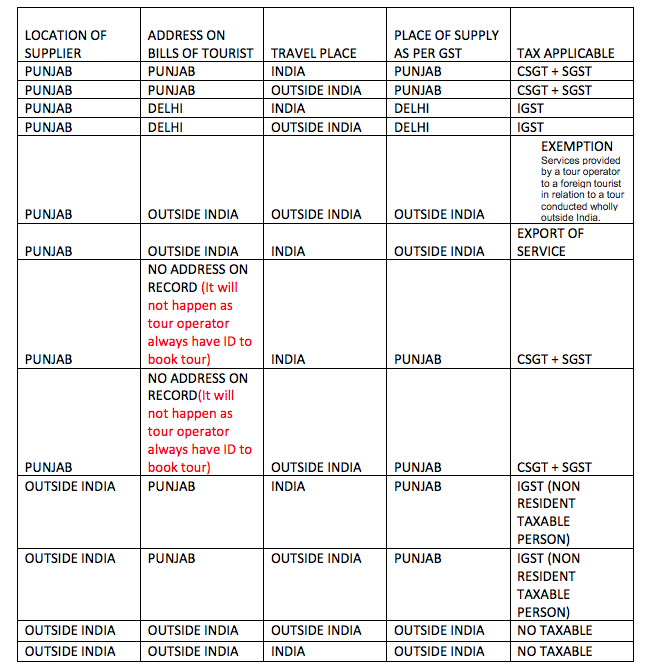

Further as per section 13(2) of IGST Act, The place of supply of services shall be the location of the recipient of services: Provided that where the location of the recipient of services is not available in the ordinary course of business, the place of supply shall be the location of the supplier of services PLACE OF SUPPLY AND APPLICABLE TAX UNDER DIFFERENT SCENERIO UNDER GST FOR TRAVEL AGENTS AND TOUR OPERATORS. Air Travel Agents also gets segment payout from Computer reservation system or Global Distribution system for reservations i .e. ATAs use software’s of certain companies to book tickets like Amadeus India, Worldspan, Galileo and Abacus. Revenue of these companies depends on number of flight reservation segments booked using their software. This way they get paid by the airlines for every flight reservation. Place of Supply of services shall be as per the general rule which says that it shall be the location of Service Receiver i.e. the place where the software company is registered. In case the services are provided by the ATA to Foreign Software Companies then the ATA would fall within the meaning of an ‘intermediary’ and hence the place of supply shall be the location of service provider i .e. the ATA in this case.

Sale of Tour Packages, both Inbound and Outbound:

Tours organized by the Tour Operator, within India for the tourist coming from abroad is generally known as inbound tours. Tours organized by the Tour Operator, outside India, for the tourist going abroad is generally known as outbound tour. tour opera tor receives commission i.e. it has booked the tour on commission basis or second on principal basis i.e. on its own account has done the various bookings and then raises bill on the client. If the tour is on principal basis then the place of supply of service shall be the location of performance of service i.e. in India and Taxable @ 5% without ITC. The bill issued for supply of this service indicates that it is inclusive of charges of accommodation and transportation required for such a tour and the amount charged in the bill is the gross amount charged for such a tour including the charges of accommodation and transportation required for such a tour. However if the tour is on commission basis then the tour opera tor will be acting as an intermediary and the place of supply shall be the location of service provider i.e. in India and hence the services will now become taxable and Taxable @ 18%.

Outbound Tour

The place of supply in case of principal to principal transaction shall be location of recipient if the receiver is registered under the GST , however If he is not registered but his address is available in the records then also that place of supply shall be the location of the service receiver and if the address is not available in the records then the location shall be the location of the service provider. The Place of supply in case where the tour opera tor receives commission from another tour opera tor situated outside India, shall be the place of the tour opera tor 1 .e. India . Outbound tour sold to a foreigner for visiting another foreign country and the payment is received by convertible foreign exchange is exempt from GST.

Travel Related Services like Visa, Passport etc.

All government fees and consular charges paid on behalf of the consumer/client is outside the purview of GSTService Charges on the above services should be subject to GST which can be collected from the end consumer.If the services are outsourced from another service provider (For example a travel agent from Chennai has to outsource a Delhi Agent to get the Visa for Uzbekistan), GST paid on the Delhi Agents Invoice can be claimed as ITC and only the difference can be paid to the Government.GST will be applicable @18% for this service.

4. Commission on Hotel Booking

In ca se of hotel bookings the tour operator is acting as an intermediary for t he purpose of booking tours for his clients. Hence in case it is domestic hotel booking then the place of supply shall be as per the general rule i.e. location of hotel In ca se it is international hotel booking then the place of supply shall be location of Agent. ‘ Service Charge from the Customer or Mark up cost to Hotel Booking from the Customer The place of supply for service where the location of Tour operator and the recipient of Service is in India shall be

Location of recipient of service if such recipient is registered personIf the recipient is not registered, a. be the location of recipient where address on record exist b. location of supplier of Service in any other case

where the location of Tour operator is in India and the location of the recipient is out of India , the place of supply in this case shall be the Location where the services are actually performed GST will be 5% with No ITC Benefit

5. CAR Rental Services, Travel Insurance

The place of supply where an agent is booking a car on hire (with or without driver ) to be further provided to any Pax or any Agent for Service charges/ Markup If the services are provided to a person located in India then the place of supply shall be the location of service recipient if the recipient is registered under the GST law . If the recipient is not registered under the law however his address is available in the records then the also the place of supply shall be the location of the service recipient. However if the address of the person is not available on records then the place of supply shall be the location of the service provider. Renting of motor cab (If fuel cost is borne by the service recipient, then 18% GST will apply) Travel Agents issues mediclaim policies and travel insurance for clients through various providers and gets commission on cut and pay basis or at the end of the month (for overseas policies). Travel Agents must be registered Insurance agent to issue mediclaim policies and travel insurance in India . The agents are required to register with IRDA as per Insurance Act, 1938. Place of Supply If the services are provided to a person located in India then the place of supply shall be the location of service recipient if the recipient is registered under the GST law . If the recipient is not registered under the law however his address is available in the records then the also the place of supply shall be the location of the service recipient. However if the address of the person is not available on records then the place of supply shall be the location of the service provider. If the mediclaim policies or travel insurance services are provided to a person who is not located in India then the services would fall in the category of ‘Intermediary’ services and hence the place of supply shall be the location of service provider GST will be applicable @ 18% for this service

RAILWAY COMMISSION

Agent is receiving commission from a foreign railway company which has its registered office out of India, the place of supply shall be determined in accordance with Section 13(9), i.e. Location of supplier of Service (INTERMEDIARY) i.e. the agent. Agent is receiving commission from a foreign railway company which has its registered office in India, the place of supply shall be determined in accordance with Section 12( 2), i.e. Location of recipient of service if such recipient is a registered person . If the recipient is not registered, be the location of recipient where address on record exist location of supplier of Service in any other case Where the agent is receiving Service charges from the Pax, the place of supply shall be determined in accordance with Section 12(2 ), i.e. Location of recipient of service if such recipient is registered person If the recipient is not registered,

be the location of recipient where address on record existlocation of supplier of Service in any other case

GST for booking for railway is @ 18%

GST Definition, ObjectiveWhen will GST be applicableWhat is IGSTSalient Features of GSTKey Features of GSTFiling of GST ReturnsGST Rates