GST on Hotels and Lodges

Impact on electricity and alcohol: One of the worries of the hotel industry which is an important part of tourism industry is the non-inclusion of electricity and alcohol tax in GST. There won’t be a single GST for the same. Hotels are known to consume tolls of electricity and not covering it under GST means not being able to fetch benefit from the input credit of the two items. Transportation: It comprises airline companies, cruise services, railways, car rentals & lots more. A tourist’s choice of transport would depend on the travel budget, destination, time, purpose of the tour & convenience to the point of destination. With the advent of GST, transport sector gets affected too. The supply of tour operator services will be taxed @ 5% with no benefit of input tax credit facility. Research & Development Cess: The research and development cess applicable on technical know-how and franchise fees are likely to be a part and parcel of GST regime. So, this is how tourism industry would likely be affected or rather be impacted by the GST.

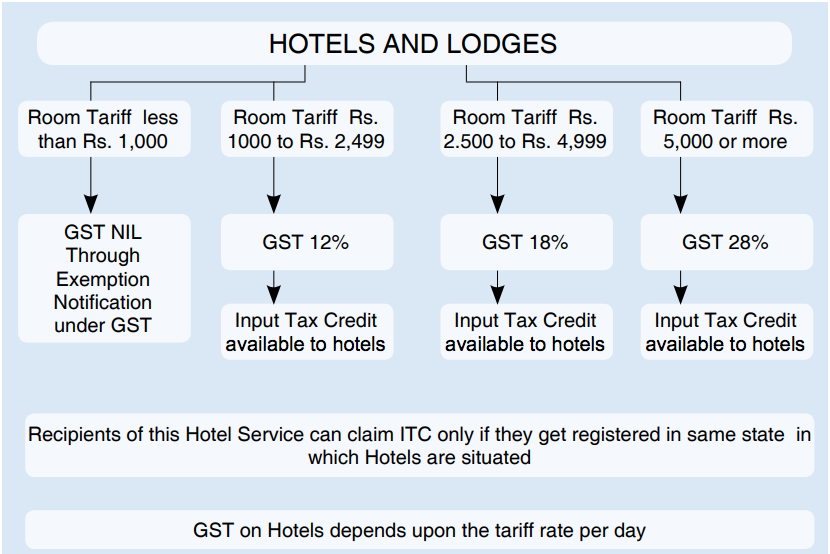

Taxability under GST

According to the CGST Law which neither contains the exemptions nor the rates of taxation, it appears that most of the services in relation to Tourism would be subject to levy of GST as the same is to be treated as ‘supply’. Since taxable event is supply, it is necessary to understand certain terms like Location of Supplier of Service, Location of Recipient of Service and Place of Supply. Tourism industry supplies bundle of services and hence Composite Supply and Mixed supply also comes into picture. Consider an example of booking of air tickets which involves cost of the meal to be provided during travel will be a composite supply and tax will be calculated on the principle supply which in this case is transportation through flight.

How Travel & Tourism Industry gets Effected?

Tourism Industry and travel and tour agents in particular are facing a tough time due to various factors like no commission by the airlines, direct marketing of airlines, higher taxation, poor tourist infrastructure etc. Their major sources of income are listed below: One has to understand that an airline or a cruise ticket or the travel insurance policy issued by insurance companies is a contract between the airline/cruise/insurance company and the passenger. The travel agent is only a facilitator who receives commission from the companies. Hence GST on these ticket/ policy will only be consumed by the passenger and the agent cannot use them as their input credit. However, the agent has to pay GST on the commission received from the airline/cruise/ insurance companies on the reverse basis. If the agent collects Service Fee as an additional charge from the passenger and show it in the invoice separately, he can add GST on the service fee in the invoice and collect the same from the passenger.

Composition Scheme in Tourism Sector

Composition scheme can be availed in tourism sector by the supplier who is engaged in providing any service or in any other manner whatsoever, of goods, being food or any other article for human consumption or any drink (other than alcoholic liquor for human consumption). Person whose aggregate turnover in the preceding financial year did not have 50 lakh rupees and not having any Inter State Supply and was neither a casual taxable person nor a nonresident taxable person, can avail the benefit under composition scheme. Rate of Tax in case of Composition scheme shall not exceed 2.5% of CGST as well as 2.5% of SGST totalling to 5%. Composition scheme proposed for restaurant, catering business which will exclude many small players out of the tax credit chain and may result into additional cascading effect in case of B2B transactions. Assessee opting for composition scheme shall not be entitled to take any credit. However, they need to pay Tax under RCM if they have any inward supply from specified person and that shall add on to their cost. Person foregoing negligible amount of input tax credit, can benefit by opting for composition scheme since their total output liability shall reduce to 5% (2.5% CGST+ 2.5% SGST) as against current liability of 9% – 10%.

Do you have to register under GST?

Travel agents / Tour Operators have to register for GST if they are providing supply of taxable services in the course of their commercial activities in India and the total (gross) taxable revenue, including of their agents is more than Rs 20,00,000. While they do not have to register if their taxable revenue is Rs 20,00,000 or less, they may be able to register voluntarily to claim the input tax credit on services purchased. The following two persons must register for GST, even if their total taxable revenue is less than Rs 20,00,000 threshold:

Tour & Travel agent who sold tour packages / air-tickets on behalf of other taxable person whether as agent or otherwise.Tour Operator selling inter-state tour packages to registered taxable personNon-resident tour & travel agents

Cancellation Fees

All cancellation fees are subject to GST at 5%. Credit note is allowed to be issued for cancellation of air ticket or tour package and GST must be adjusted accordingly. Any amendment charges are subject to GST at 5% for inbound/ outbound tour package and domestic air tickets. Amendment charges for outbound tour package and international air ticket are subject to GST at 5%. Arranging for visa and visa fees; (the service or administrative fees imposed) is subject to GST at 18%.

Hotel Industry in GSTGST Impact on Hotel IndustryGST and its impact on Salaried EmployeesGST Impact on the Travel IndustryGST Impact On Transportation of Goods