Composition Scheme is a simple and easy scheme under GST for taxpayers. Small taxpayers can get rid of tedious GST formalities and pay GST at a fixed rate of turnover. This scheme can be opted by any taxpayer whose turnover is less than Rs. 1.0 crore*.

Update as per Notification dated 29.12.2017

The late fees for failure to furnish returns in GSTR-4 by the due date have been waived off to the extent of the amount in excess Rs. 50 per day for every day the failure continues. In case of the filing of Nil Returns in GSTR-4, The late fees for failure to furnish return by the due date, have been waived off to the extent of the amount in excess of Rs. 20 per day for every day the failure continues.

*As per 23rd GST Council Meeting held on 10th Nov 2017

The main threshold for composition scheme was recommended for an increase to Rs. 1.5 crore (from earlier 1 crore). But this is yet to be notified.

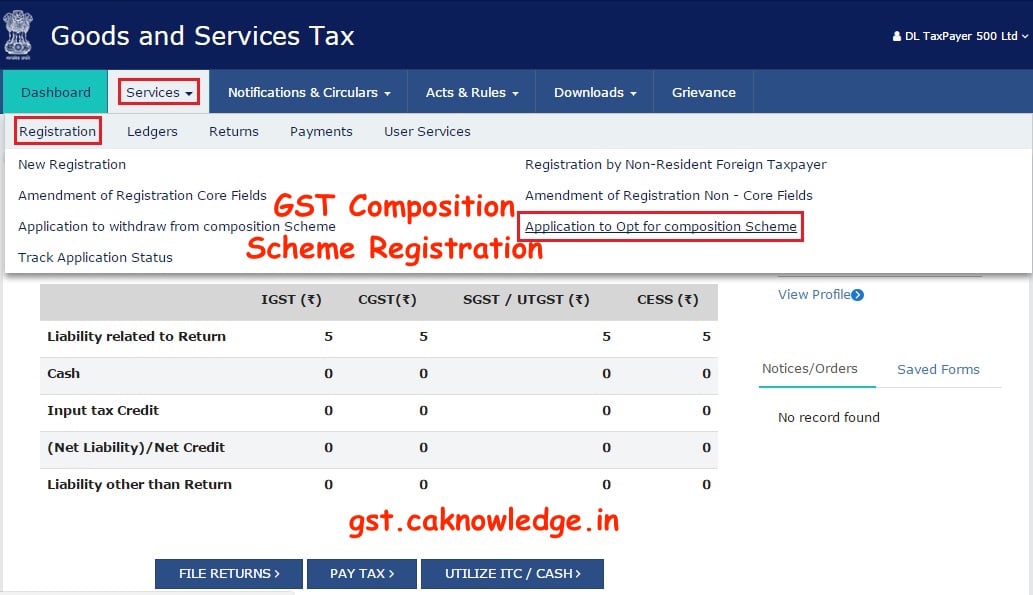

GST Composition Scheme Registration

Businessmen with annual turnover of more than Rs. 20 lakhs and up to Rs. 1 crore* lakhs can take advantage of composite schemes coming in GST. Under the composite scheme, the tax rate is low. Under this scheme, the traders will have to pay only 2 per cent tax. The advantage of this scheme can be bought by Retailer, Wholesaler, Restaurant Businessman, MSME, Manufacturing. If the turnover of these traders is more than Rs 20 lakh and up to Rs 1 crore*. In GST, you have to pay tax at an annual rate of 2 per cent.

Video Guide for GST Composition Scheme Registration

Click here to Watch Video on Youtube

How do I opt for the Composition Scheme?

What are the steps involved in applying to Opt for the Composition Scheme on the GST Portal?

To opt for the composition scheme on the GST Portal, perform the following steps:

- Access the https://www.gst.gov.in/ URL. The GST Home page is displayed. In case of New Registration:

- Log into the GST Portal by entering your login Credentials.

- Once you have logged in, select ‘Application to Opt for Composition Scheme’ from the Registration Menu.

- You will be directed to a new screen – Application to Opt for Composition Scheme. Your GSTIN, Legal Name of Business, Trade Name (if any), and Address of Principal Place of Business will be displayed.

- Below that, your Nature of business and Jurisdiction will be listed.

- Below these details, there is a Composition Declaration that you must check to pledge to abide by the conditions and restrictions for Taxpayers who are under the Composition Scheme.

- Before submission, you must also check the box for Verification (below the Composition Declaration) that states that all the information given is true and that nothing has been concealed from the authority.

- Finally, before submission, select the Authorized Signatory from the dropdown menu and enter the Place. 9. Once you select the Authorized Signatory and enter the Place, the options to submit the form will get activated. Select the desired mode – DSC, E-sign, or EVC – and click the corresponding submission option. For the purpose of this manual, we will submit the application using DSC.

- You will get a prompt to confirm your action, click on PROCEED to move forward.

- The system will retrieve the installed digital signatures available on your system using the emSigner and you will get a pop-up to select the desired DSC. Select the desired signature.

- Once you select the desired digital signature (it will get highlighted in blue), click Sign. If your digital signature is authenticated, you will get a SUCCESS message.

- The system will perform some validations and if they are successful your ARN for the work item will be generated and sent to you via e-mail and SMS within the next 15 minutes