Why Documents Need to be Franking ? and Latest Income Tax Slab Rates AY 2017-18 & All Years like For AY 2015-16, AY 2017-18 or FY 2015-15, 2016-17 etc. Now today we Provide full Guide for Form 16. You can Download Form 16 Excel Utility for AY 2014-15, 2013-14 and For 2012-13 so Why you are Waiting Scroll Down Below and check complete details for Form 16 TDS – Understand Form 16 – Download Excel Utility. If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” freely “ Recommended Articles

Download Latest Income Tax Return (ITR) FormsWhat is Franking ? Why Documents Need to be Franking ?Various Due Dates For Indian TaxesProcedure for Request of Re-issue of Income tax RefundHow to E-File Income Tax Return Online – Full GuideHow to Pay TDS Online Full Guide and Procedure

About Form 16 TDS

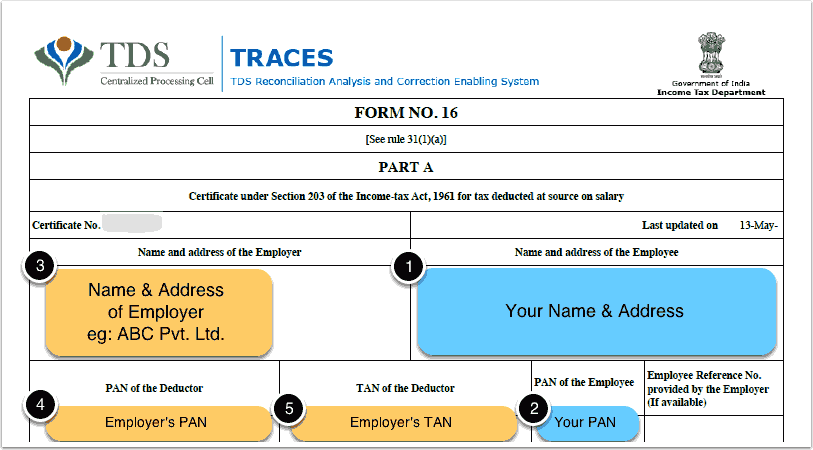

Certificate under section 203 of the Income-tax Act, 1961 for tax deducted at source from income chargeable under the head “Salaries”. Form 16 is a certificate or a document that is issued to salaried personnel in India by their respective employers. The certificate carries necessary details that assist in the process of filing Tax Returns with the Income Tax Department of India. Also Read –

Features and Important Components of Form 16All you should know about Form 16 and Form 16ADownload Form 16 with tax calculation formulas for AY 2017-18

Form 16 is a document that is used by salaried personnel as part of the process of filing Income Tax Returns in India. The Income Tax Act of 1961 and the Income Tax Rules of 1962 are the governing laws of the Income Tax Department of India. The Form 16 is an important document that is in accordance with the rules and regulations laid down by the Income Tax Department as well as the Government of India. The Form 16 is provided by an Employer to the Employee and is used by the employee as reference as well as proof while filing Income Tax Returns. The Form furnishes various details such as Salary Income components of the Employee, Tax Deducted at Source (TDS) by the Employer, and Tax paid by the Employer to the Income Tax Department.

Download Form 16 in Excel and PDF Utility

Download Form 16 with tax calculation formulas for AY 2017-18Download Form 16 for AY 2016-17 (FY 2015-16) In ExcelDownload Form 16 for FY 2014-15 (AY 2015-16) Download Form 16 for AY 2014-15

Recommended Articles

Form 3CA 3CB 3CD In Word Excel & Java FormatIncome Tax Slab RatesList of All Incomes Exempt from Income TaxPAN Name By PAN NoHow to submit Response for Outstanding Tax Demand