Filing & Payment Requirements for TDS on Property 26QB

While transferring the property from one person to other, the buyer or the investor needs to deduct the amount from the amount to be paid to seller or the builder and needs to deposit it to government. But it is not applicable for all. The conditions for the same are, that if the proceeds for the property are more than or equal to Rs. 50 Lakh, than 1% TDS needs to be deducted and deposited. Here the person is not required to obtain the TAN number as the payment would be made on the based of PAN number. In the form, it would be directly paid through the information of PAN of buyer and the seller. There is also another confusion that if the property value is more than Rs. 50 Lakhs than it should be deducted on the total amount or the total amount. The answer to the above confusion is it should be deducted on the total amount.

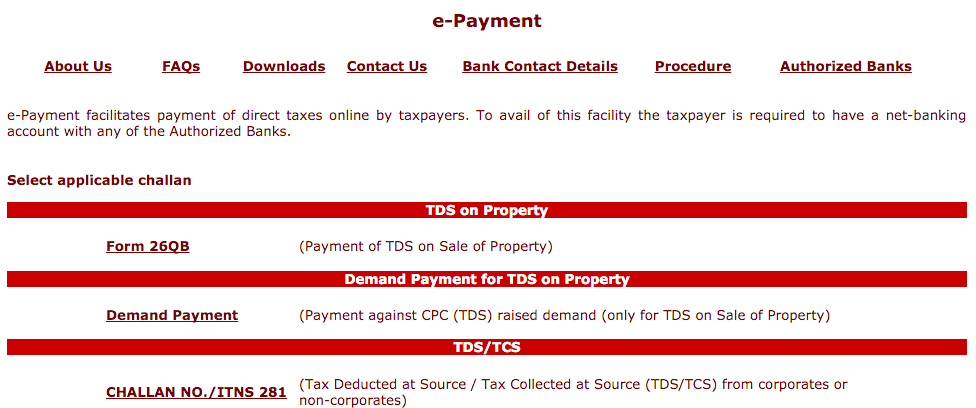

There are two options available for the payment of Form 26QB.

Option 1 – Direct Option

Option 2 – Other option

Downloading Form 16B for TDS on Property

If you have any query regarding “TDS on Property 26QB” then please post your query via below comment box… Recommended Articles

TDS on Non residents – Section 195TDS Section 194IA – Objectives, Concepts, Rate of TDSTDS on sale of Immovable Property – TDS Section 194IATDS on Employees Provident fund withdrawalInterest on Non Payment or Non Deduction of TDSAmendments brought in TDS and TCS