To submit a grievances / complaints regarding GST Portal, perform the following steps:

- Access the GST Portal by visiting the URL www.gst.gov.in

- Login with your credentials. Grievances can be submitted either before or after logging-in to the GST Portal, however, payment related grievances can only be submitted by registered users or Taxpayers, since they are required to mention the GSTIN.

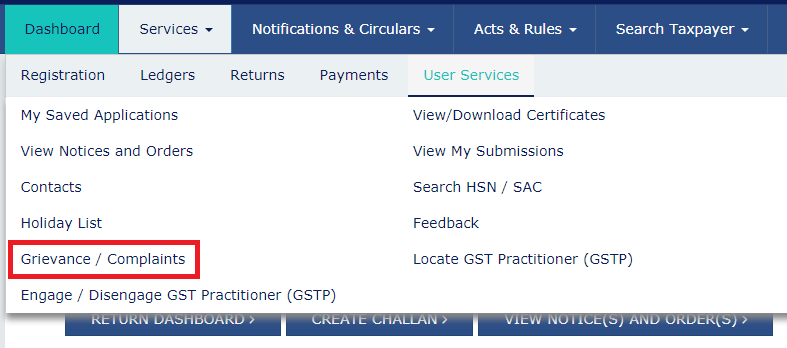

- Click the Services > User Services > Grievance / Complaints command. The Grievance / Complaints page is displayed. The Submit Grievance section will open by default.

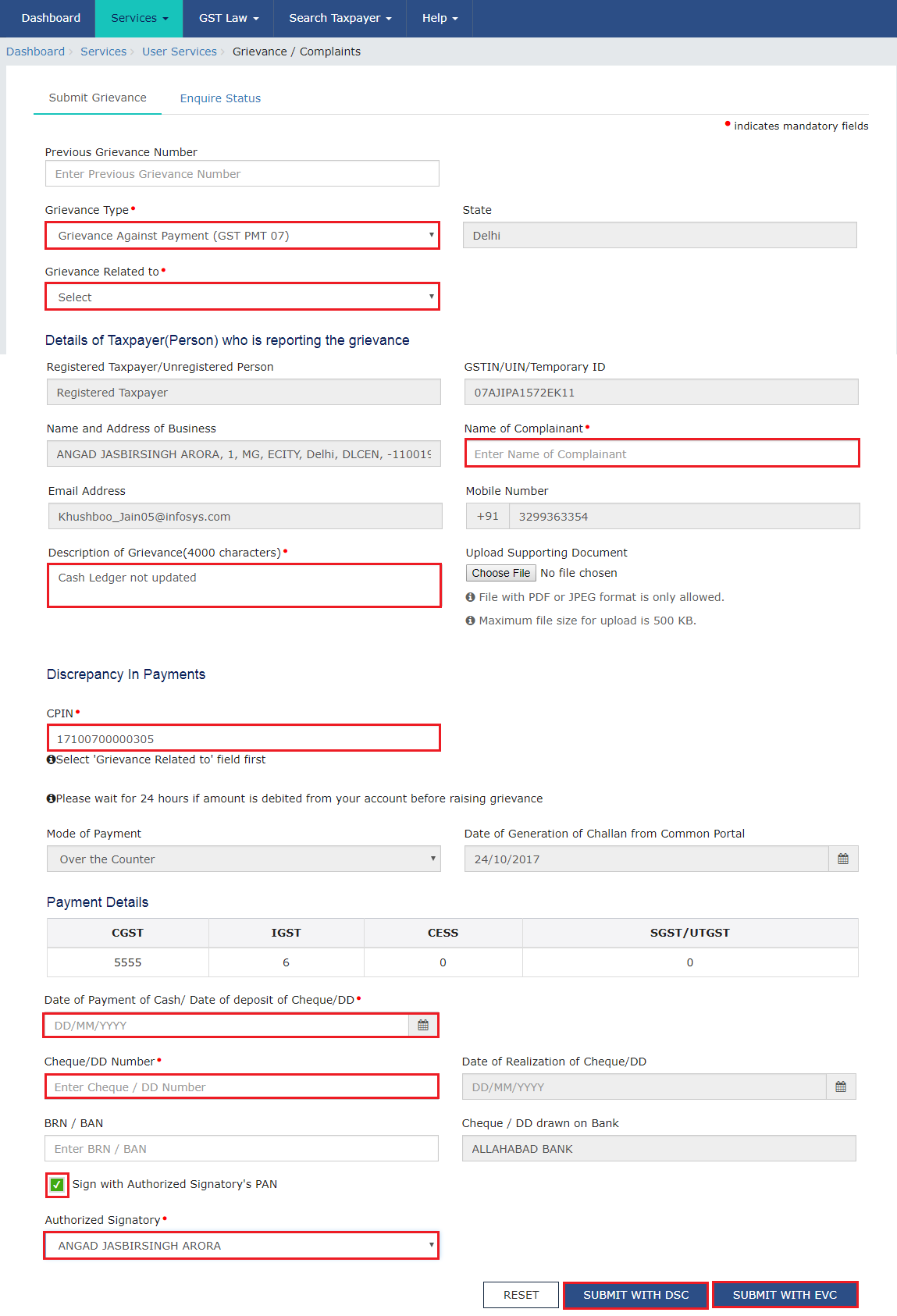

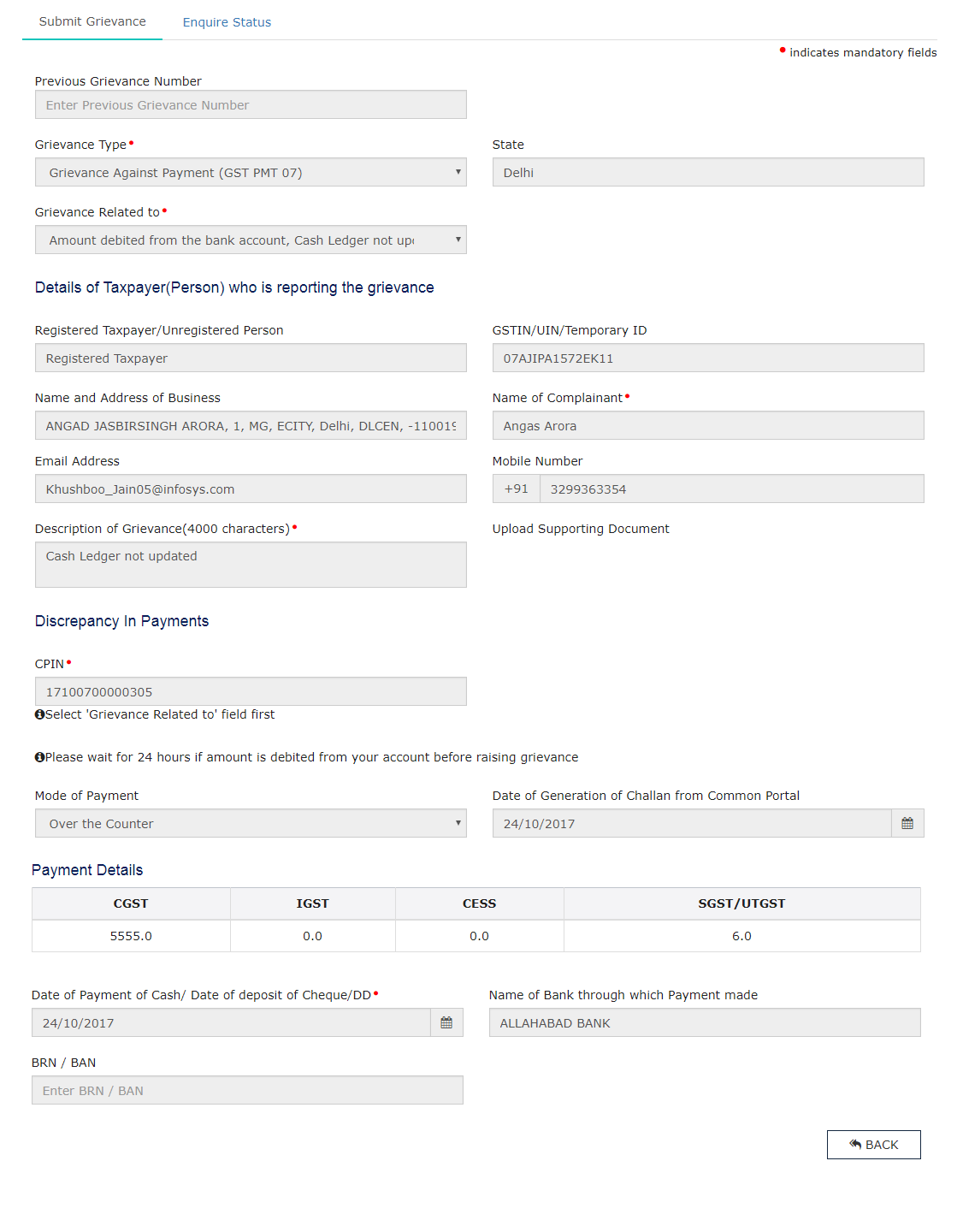

- In case you have already filed a grievance and you are filing the grievance again, enter the previous grievance id in the Previous Grievance Number field.

- In the Grievance Type drop-down list, select the Grievance Against Payment (GST PMT 07) option.

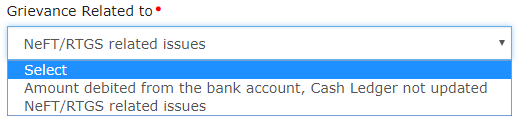

- In the Grievance Related To drop-down list, select one of the available two options:

Amount debited from the bank account, Cash ledger not updatedNEFT/ RTGS related issue

- In the Discrepancy In Payments section, in the CPIN field, enter the CPIN of the Challan.

- In case of pre-login, enter Capcha code.

- Select the Sign with Authorized Signatory’s PAN option and select the Authorized signatory.

- Click the SUBMIT WITH DSC or SUBMIT WITH EVC button to submit the grievance form.

FILE WITH DSC:

a. In the Warning box that appears. Click the PROCEED button.b. Select the certificate and click the SIGN button.

FILE WITH EVC:

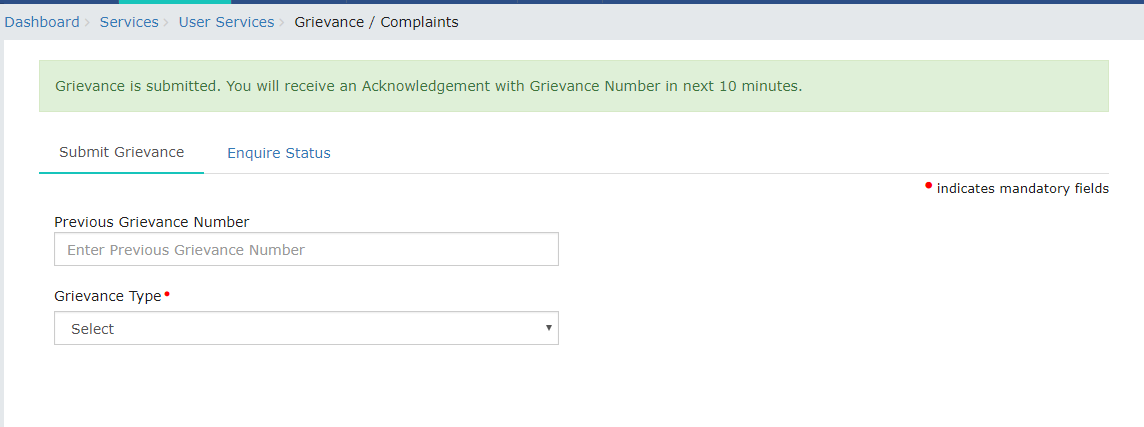

a. Enter the OTP sent on email and mobile number mentioned in the grievance form and click the VALIDTATE OTP button. On submitting the grievance form, the GST Portal will generate a Grievance Tracking Number and send it to the e-mail address as mentioned in the form. You can check your grievance status after 10 minutes, using the ‘Enquire Status’ service.

How can I monitor the progress / status of my submitted grievance?

To monitor status of your submitted grievances / complaints regarding the GST Portal, perform the following steps:

- Access the GST Portal by visiting the URL www.gst.gov.in

- Login with your credentials. Status of a Grievances can be enquired before or after logging-in to the GST Portal.

- Click the Services > User Services > Grievance / Complaints command. The Grievance / Complaints page is displayed.

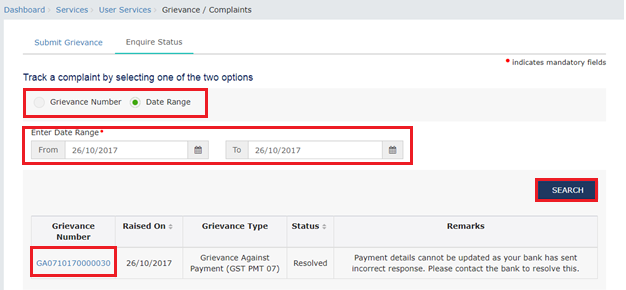

- Click the Enquire Status section.

- Enter either your Grievance Number or Date Range. In case you have not logged in you can only search the Grievance Number.

- Click the Search button. The search result will get displayed, allowing you to access the status of your submitted grievance. If you are logged-in to the portal and have searched using the Date Range option, the search result will display the status of all submitted grievances along with their respective Grievance Numbers. All grievances will show one of the following statuses, depending on their resolution path and check point:

Submitted: On submission of grievanceResolved: Once the grievance gets resolved.

Clicking the Grievance Number will display the corresponding details in read-only mode. Recommended Articles

Debit Note under GSTCredit Note under GSTGST Rates in IndiaGST FormsGST DownloadsGST Invoice FormatGST RegistrationGST LoginGST Returns