Now, first, we have to understand what depreciation actually means. We know, to carry on day-to-day operations, every organisation has to deploy numerous fixed assets to use. Quite obviously, no asset can perform with the same capacity all throughout its life. It will face gradual wear and tear due to continuous usage or maybe because of remaining idle for so long. This results in a reduction of efficiency of the concerned asset. The phenomenon discussed above is commonly termed as depreciation. We have to keep in mind that as depreciation as a concept is important, it’s accounting is also important. There are various scientific methods of accounting for depreciation. The most important of them are the straight-line method and the written down Value method (as per your syllabus). Thus there are 3 important factors for computing depreciation:

Estimated useful life of the assetCost of the assetResidual value of the asset at the end of the of its estimated useful life

Depreciation is allocated so as to charge a fair proportion of the depreciable amount in each accounting period during the expected useful life of the asset.

Straight line method

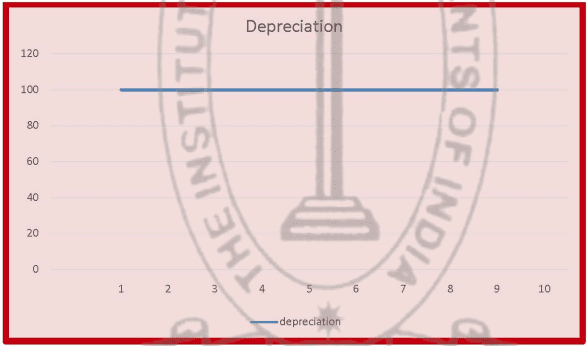

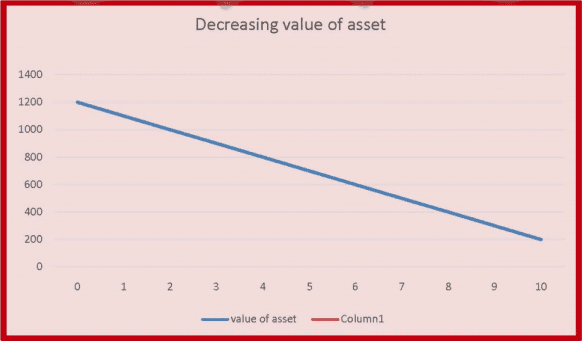

this method is the simplest way of calculating depreciation on fixed assets. Under this method, the cost of purchase of the concerned fixed asset, the salvage value(scrap value) of the asset, and duration of use are considered. This method is also known as the original cost method, because, the rate of depreciation is applied on the original cost of the machine. To ascertain the amount of depreciation to be allocated to an asset, the following formula is used: Under this method, total depreciation of an asset is apportioned equally along with the duration of use. Suppose, total cost of an asset is Rs. 1200 and it is used by the organisation for 10 years. Let, the scrap value of the asset be Rs. 200. So, the amount of depreciation to be th allocated per year would be: (1200-200)/10 = Rs. 100. So, at the end of the 10 year, the value of the asset would be completely diminished. Hence, from the above chart, we can see that the trend of depreciation follows a straight line. That is why, the method discussed above is commonly referred as straight line method. From the above chart, we can see that the value of asset decreases at a constant rate. That is why, the diagram is a downward sloping straight line. Though this method is simple to follow and account for, but it is not completely logical. Because, in real life, no machine is equally used all along its life. So, in real scenario, the amount of depreciation would differ.

Written down value method:

under this method, an asset is depreciated at a particular rate which is charged on the value of asset on st the 1 day of each financial year. So, unlike straight line method, amount of depreciation would be different each year and it will gradually decrease. This method is more logical as the depreciation is charged on the effective value of the asset instead of its original cost. Suppose, cost of an asset is Rs. 1000 and rate of depreciation is 10%. So, for the first year, amount of depreciation would be (100010%)= Rs. 100. So, the written down value of the asset on the first day of next financial year will be Rs. 900. In this year, depreciation will be charged @10%on Rs. 900, viz: 90010% = Rs. 90. Hence, this process will continue until the value of the asset reaches zero.

PROVISION FOR DEPRECIATION:

Now we will focus on the very important method of accounting for depreciation which is called “provision for depreciation method”. Please remember that this is not a method of CALCULATING depreciation but a method of ACCOUNTING. In this method we prepare the asset account at cost, provision for depreciation account and a machinery disposal account. Let us discuss in detail. Under this method depreciation is separately recorded in provision for depreciation account. The fixed asset account appears at its original cost. In the profit and loss account current period’s depreciation is only recorded. In the balance sheet fixed asset account is disclosed by deducting the accumulated depreciation i.e. the depreciation till the balance sheet date from the original cost.

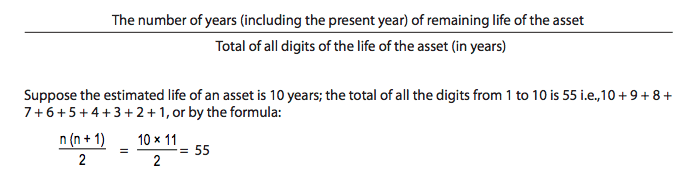

Sum of Years of Digits Method

It is variation of the “Reducing Balance Method”. In this case, the ansnual depreciation is calculated by multiplying the original cost of the asset less its estimated scrap value by the fraction represented by: The depreciation to be written of in the frst year will be 10/55 of the cost of the asset less estimated scrap value; and the depreciation for the second year will be 9/55 of the cost of asset less estimated scrap value and so on. The method is not yet in vogue; and its advantages are the same as those of the Reducing Balance Method.

Annuity Method

This is a method of depreciation which also takes into account the element of interest on capital outlay and seeks to write of the value of the asset as well as the interest lost over the life of the asset. It assumes that the amount laid out in acquiring asset, if invested elsewhere, would have earned interest which must be reckoned as part of the cost of asset. On that basis, the amount of depreciation to be annually provided in the accounts is ascertained from the Annuity Tables, to write of each year interest on the capital outlay as well as part of the capital sum at a rate that the whole of the capital sum and interest accruing thereon would be written of over the life of the asset. Though the amount written of annually is constant, the interest in the earlier years being greater, only small amount of the capital outlay is written of. This proportion is reversed with the passage of time. This method is eminently suitable for writing of the amounts paid for long leases which involve a considerable capital outlay. It is not practicable to adopt this method for writing of depreciation of plant and machinery on account of frequent changes in the value of such assets which would necessitate the recalculation of the amount of depreciation to be written of annually.

Sinking Fund Method

If a large sum of money is required for replacement of property, plant and equipment at the end of its efective life, it may not be advisable to leave in the amount of depreciation set apart annually, for it may or may not be available in the form of the readily realisable assets to the enterprise at the time it is required. To safeguard this position, the amount annually provided for depreciation may be placed to the credit of the Sinking Fund Account, and at the same time an equivalent amount may be invested in Government securities. The interest on these securities, when received, would be re-invested and the amount thereof would be credited to the Sinking Fund Account. The amount of annual provision for depreciation in such a case is calculated after taking into account interest, that the amounts annually invested shall be earning over the period these will remain invested. When the asset is due for replacement, the securities are sold and the new asset is purchased with the proceeds of their sale. The book value of the old asset, at the time, is transferred to the Sinking Fund Account. Any amount realised on sale of the old asset, as well as the proft or loss on sale of securities, is transferred to the Sinking Fund Account and it is closed of by transfer of the balance of the Proft and Loss Account or General Reserve. The amount to be set apart annually by way of depreciation is ascertained from Sinking Fund tables. They readily show the amount which must be invested each year to accumulate to Rs 1 at a given rate of interest within the stated period. Recommended

IND AS 36 Impairment of AssetsDepreciation rates as per companies act 2013Fixed price methodInd AS 16Depreciation Accounting