There should be different ledgers for tracking the liability, recovery or interim recovery under GST else it will be a challenge. Say for example if there is only one account of GST liability account, then it will be a challenge to reconcile the same and state separately for the transactions related to the interstate, stock transfer or for reporting of purchases from unregistered taxpayers or advance received.

Accounting under Goods and Service Tax

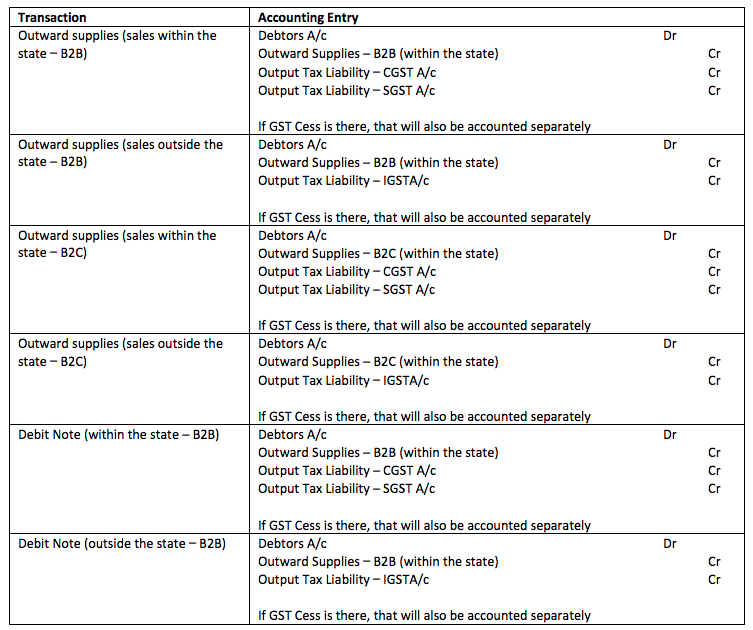

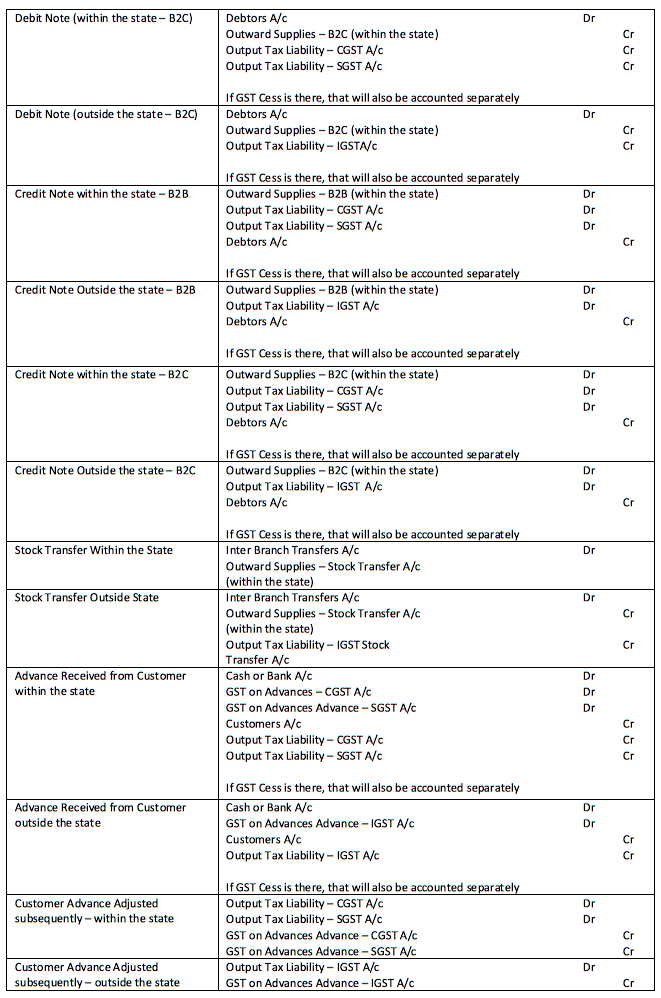

In this section, we will see the major accounting entries to be generated under GST along with the new ledger accounts/ Chart of accounts to be created in the accounting software or ERP. The granular level for capturing the reporting requirements under GST. In the GST returns we need to show data under various sections.

Accounting Ledgers in GST

Output Tax Liability

For accounting, the output tax liability which is directly related to outward supplies it is recommended to have ledger accounts tax wise and for goods and services separately. This will help in reconciling the return data with the accounts directly without any manual intervention.

Output Tax Liability – CGST A/cOutput Tax Liability – SGST A/cOutput Tax Liability – IGST A/cOutput Tax Liability – UTGST A/cOutput Tax Liability – GST Cess A/cOutput Tax Liability – IGST – Stock Transfer A/c

Outward Supplies – Within the State

These accounts will be used for tracking Outward supplies i.e., sales within the state. These accounts have to be created separately for goods and services as we have a requirement to show them separately basis on the format of the monthly GSTR – 1return.

Outward Supplies – B2B (table 4)Outward Supplies – B2C (table 7)If required can also have separate ledger accounts for B2C large, that is for supplies to unregistered taxpayers where the invoice value is more than Rs 2.5 Lacs.

Outward Supplies – Outside the state

These accounts will be used for tracking Outward supplies i.e., sales outside the state. These accounts have to be created separately for goods and services as we requirement to show them separately basis on the format of the annual return released in September 2016.

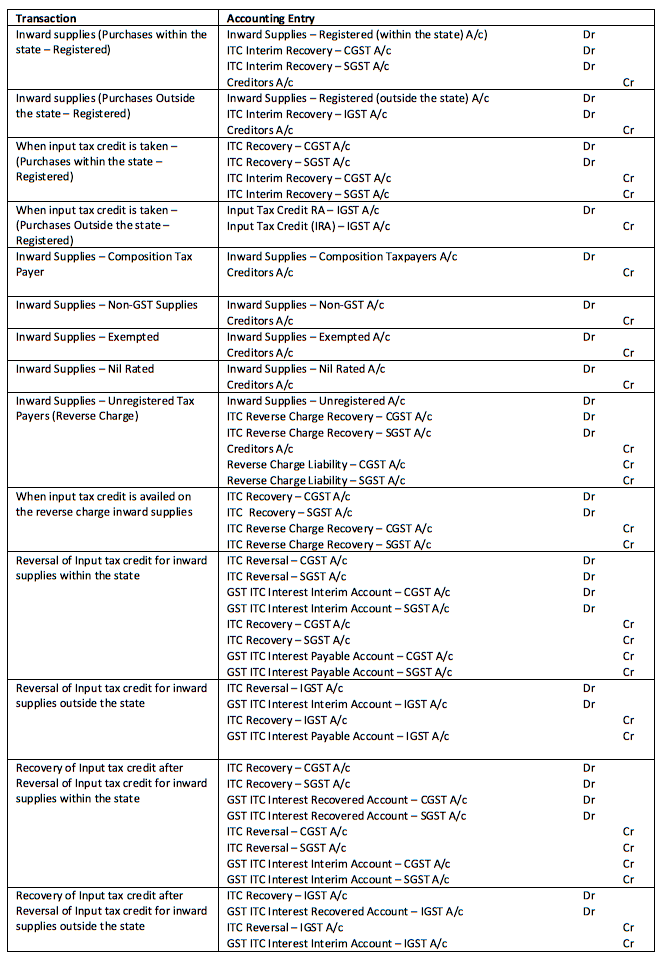

Reverse Charge Liability Accounts

For inward supplies i.e. purchases which are made from unregistered tax payers in GST, Reverse Charge is applicable to such transactions and for tracking such liability this account will be useful. Many of the taxpayers are of the impression that the reverse charge is differed from time to time and now based on the latest notification 10/2018- Central Tax (Rate), dt. 23-03-2018 it is differed till 30th June 2018 under Section 9, Sub-section of the CGST Act but still reverse charge liability is applicable on the notified list of goods and services falling under Section 9, Sub-section 3 of the CGST Act.

Reverse Charge Liability – CGST A/cReverse Charge Liability – SGST A/cReverse Charge Liability – IGSTA/cReverse Charge Liability – UTGSTA/cReverse Charge Liability – GST Cess A/c

GST on Advances

As per the provisions of the Time of Supply in Sections 12 and 13 of the CGST Act 2017, GST liability has to be paid on receipt of advance form the customers for goods and services, but the same is now differed for the goods wide Notification 66/2017-Central Tax, dt. 15-11-2017. It is still applicable to service providers or the taxpayers providing services. To track the liability of such advances it has to accounted separately and the same can be reconciled on a monthly basis in Table 11A of the GSTR – 1 and for issue of the receipt voucher and while returning the advances to the customers wide refund voucher which will be adjusted in table 11(B) of the GSTR – 1.

GST on Advances – CGST A/cGST on Advances – SGST A/cGST on Advances – IGSTA/cGST on Advances – UTGSTA/cGST on Advances – GST Cess A/c

ITC – Interim Recovery Account

These accounts are to be created in case if the organization decides to take input tax credit only on updating in the Electronic Credit Ledger Account, this will give full control and information on which invoices input tax credit is not availed. Moreover, it helps the management in follow up and in decision making process also. This option would make sense in case of matching of suppliers and recipients returns. Though it may have some stress on the working capital it will ensure that there is no requirement of paying interest in case if the supplier of goods or services does not file the return and also safeguard the compliance ratings as and when introduced.

ITC Interim Recovery Account – CGST A/cITC Interim Recovery Account) – SGST A/cITC Interim Recovery Account – IGSTA/cITC Interim Recovery Account – UTGSTA/cITC Interim Recovery Account – GST Cess A/c

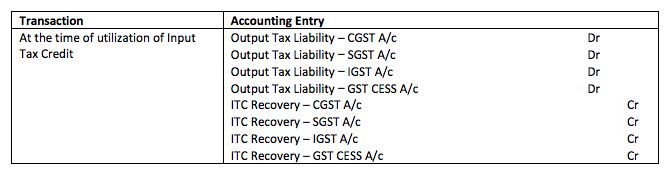

Input Tax Credit – Recovery Account

This account can be updated when the input tax credit is reflected in the Electronic Credit Ledger Account and for this accounting or ERP being used should be supporting it.

ITC Recovery –CGST A/cITC Recovery – SGST A/cITC Recovery – IGSTA/cITC Recovery – UTGSTA/cITC Recovery – GST Cess A/c

Input Tax Credit – Reverse Charge Recovery Account

This account can be updated when the input tax credit is reflected in the Electronic Credit Ledger Account and for this accounting or ERP being used should be supporting it.

ITC Reverse Charge – CGST A/cITC Reverse Charge – SGST A/cITC Reverse Charge – IGSTA/cITC Reverse Charge – UTGSTA/cITC Reverse Charge – GST Cess A/c

Input Tax Credit – Reversal Account

As per the provisions of the GST, the input tax credit availed if the supplier of the goods and services or both is not paid within 180 days, the input tax credit availed has to be reversed along with interest. in such cases when the input tax credit account is reversed, it will be parked in this reversal account. The input tax credit can be availed only as and when the supplier of goods or services or both is paid subsequently. These accounts have to be maintained at the registration number level i.e. at the state level in most of the cases. Based on the accounting package or ERP a new ledger account can be created or the option of using the DFF or GDF in Oracle Applications or any other name whatever it is called.

ITC Reversal –CGST A/cITC Reversal –SGST A/cITC Reversal –IGSTA/cITC Reversal –UTGSTA/cITC Reversal –GST Cess A/c

ITC – GST Interest Payable Account

On the one hundred and eighty first day the input tax credit has to be reversed along with the Interest has to be paid at the time of reversal of input tax credit, and for an accounting of the same, this account will be used. Based on the accounting package or ERP a new ledger account can be created or the option of using the DFF or GDF in Oracle Applications or any other name whatever it is called.

GST ITC Interest Payable Account – CGST A/cGST ITC Interest Payable Account – SGST A/cGST ITC Interest Payable Account – IGSTA/cGST ITC Interest Payable Account – UTGSTA/cGST ITC Interest Payable Account – GST Cess A/c

ITC – GST Interest Interim Account

The amount of interest paid on the one hundred and eighty first day will be reversed as and when the supplier of the goods or services or both is paid back. Until the point of time the supplier is paid, the same is parked in the interest interim account. Based on the accounting package or ERP a new ledger account can be created or the option of using the DFF or GDF in Oracle Applications or any other name whatever it is called.

GST ITC Interest Interim Account – CGST A/cGST ITC Interest Interim Account – SGST A/cGST ITC Interest Interim Account – IGSTA/cGST ITC Interest Interim Account – UTGSTA/cGST ITC Interest Interim Account – GST Cess A/c

ITC – GST Interest Recovered Account

On payment to the supplier, the input tax credit is eligible again and at the same time the amount of interest paid at the time of reversal is also eligible, and it can be used only for future payment of interest.

GST ITC Interest Recovered Account – CGST A/cGST ITC Interest Recovered Account – SGST A/cGST ITC Interest Recovered Account – IGSTA/cGST ITC Interest Recovered Account – UTGSTA/cGST ITC Interest Recovered Account – GST Cess A/c

Input Tax Credit – Reverse Charge Recovery

On payment of taxes under reverse in cash, input tax credit is available, and for tracking of that, we will use this account.

ITC Reverse Charge Recovery – CGST A/cITC Reverse Charge Recovery – SGST A/cITC Reverse Charge Recovery – IGSTA/cITC Reverse Charge Recovery – UTGSTA/cITC Reverse Charge Recovery – GST Cess A/c

Inward supplies

These accounts are required to be captured to for reporting the inward supplies under various categories in the GSTR – 2 returns.

Inward Supplies – Registered (within the state)Inward Supplies – Registered (Outside the state)Inward Supplies – UnregisteredInward Supplies – Composition Taxpayers A/cInward Supplies – Exempted A/cInward Supplies – Non-GST A/cInward Supplies – Nil Rated A/c

The above accounts have to be created for each registration number in case if you have a presence in more than one state. In case if you are using any ERP, you can explore the usage of the sub-ledgers or whatever name you call it at the account level.

Accounting entries for Outward Supplies

Since the new financial year is starting shortly, this is the right time to revisit the existing Ledger accounts or chart of accounts and create new once where ever required and prepare for the next GST return filing seamlessly. For a finance person or indirect tax person, the heart is the chart of accounts or the ledger accounts and if we have this in place, the return filing and reconciliation will be simple. Recommended Articles

GST DefinitionFiling of GST ReturnsHSN Code ListGST LoginGST RulesGST Rates